Hot Projects

XRP To Skyrockets To $1.33 Amidst April Rally: Analysts | MATIC News

XRP has demonstrated significant strength for a while now, securing its spot as one of the best-performing cryptocurrency assets by market cap, after surging to its highest level since November.

XRP To Yield Gains From April Rally

The crypto community is buzzing about XRP’s latest price spike as several analysts predict the surge will be the start of the eagerly anticipated rally. With a 50% rise from $0.50 on Monday, March 11, to a weekly high of $0.75, it got off to a great start this week.

Cryptocurrency analyst and trader Dark Defender has shared his latest optimistic forecast for XRP with the community on X (formerly Twitter). Dark Defender highlighted that the crypto asset “broke out” from a strong resistance on Tuesday, just as he expected.

XRP broke out from a 6-year-long symmetrical triangle, which denotes a phase of consolidation with prices bouncing between the lower support line and the upper resistance.

According to the analyst, the monthly time frame clearly shows that the much-anticipated move has begun. Also, the daily time frame “confirms that the massive resistance level of $0.6649 has been broken.”

He further added that for the “weekly and monthly time frame, $0.6649 will possibly be confirmed.” As a result, Dark Defender underscored that his targets are now “closer to the mid-resistance around the $1.33” price mark. Meanwhile, he has placed his “Fibonacci price targets at $1.88 and $5.85 in the upcoming weeks.”

The post read:

XRP had the break-out yesterday, as we expected. In the Monthly Time Frame, it is obvious the move has started and the huge Resistance of $0.6649 has been confirmed to be broken in the Daily. $0.6649 will be Confirmed for the Weekly and Monthly Frames. Our targets are closer now to $1.33 mid resistance, and $1.88 and $5.85 Fibonacci targets in the upcoming weeks.

As a result, the expert has urged the community to watch out for “solid strikes” in the coming week. In addition, he noted that “April will be hot,” suggesting significant gains throughout the month.

Presently, the digital asset gradually gaining strength trading at $0.6897, indicating a weekly increase of over 12%. However, its market cap and trading volume are both down by 1.58% and 57% in the last 24 hours.

The Asset Does Not Belong In Your Portfolio

Despite XRP’s latest rally, crypto expert Jason Pizzino has claimed that investing in the token might not be a smart move. Jason Pizzino has issued a warning to the community never to consider adding XRP to their portfolio.

He claims that “even though it climbs this cycle, it still “needs to rise more than 2600%” in value to match Bitcoin‘s peak of 2017. “It achieved 500% in the previous cycle and is now only 30% away from shattering the SEC Lawsuit low,” he added.

Pizzino believes that the major advantage of influencers discussing XRP is that there is still a “large audience interested” in knowing about the project and “optimistic price projects that never appear.”

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Hot Projects

Expert Predicts When Bitcoin Price Will Reach Its Cycle Highs | MATIC News

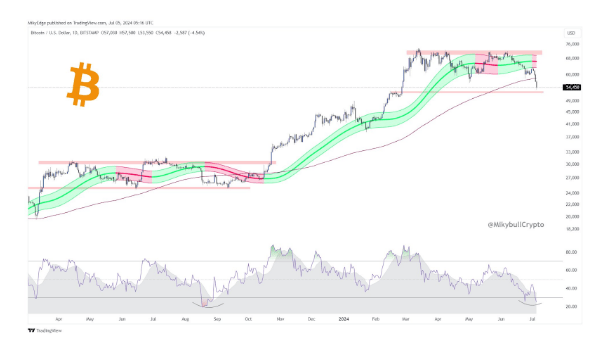

Crypto analyst Rekt Capital has provided insights into when the price of Bitcoin will reach its cycle highs. His analysis has provided reassurance that the flagship crypto is still far from a market top despite its recent decline to new lows this week.

Related Reading

When Will Bitcoin Peak In This Bull Run

Rekt Capital mentioned in an X (formerly Twitter) post that Bitcoin could peak in this cycle sometime in mid-September or mid-October 2025 if history were to repeat itself. The analyst noted that Bitcoin peaked 518 days after the halving event during the 2017 bull run and 546 days after the halving event during the 2021 bull run.

Based on this, the analyst predicts that Bitcoin’s market top in this bull could occur between 518 and 546 days after the halving event, which happened earlier in April. This timeline puts the projected peak for Bitcoin sometime in September or October next year. Meanwhile, Rekt Capital again alluded to the fact that Bitcoin was accelerating in this cycle by 260 days earlier this year.

However, that is no longer the case thanks to the over three-month consolidation period the flagship crypto has experienced since the halving event. Rekt Capital claimed that the rate of acceleration has “drastically dropped and is now approximately 150 days.” He added that Bitcoin will likely resynchronize with the traditional halving cycle the longer it consolidates.

The crypto analyst has also refused to be deterred by Bitcoin’s current price action, which some claim suggests that the bull run is over. However, Rekt Capital has repeatedly stated that Bitcoin will retrace deep enough to convince anyone that the bull run is over, and then it will continue its uptrend.

In another X post, Rekt Capital mentioned that Bitcoin’s downtrend, which began last month, is one to watch for a major trend shift. The analyst remarked that a break of the “multi-week downtrend would result in the beginning of at least a multi-week uptrend” for the flagship crypto.

Bitcoin is now trading at $56,693. Chart: TradingView

‘This Is Not The Cycle Top Vibes’

Crypto analyst Mikybull Crypto also believes that the cycle top isn’t in yet despite Bitcoin’s recent decline, stating that this price action “is not the cycle top vibes.” The analyst also said that Bitcoin’s current sell-off bottom might be closer than everyone thinks and noted that this scenario played out in the third quarter of 2023 when most people thought it was over.

Related Reading

The analyst previously mentioned that the cycle top isn’t in yet and simply classified this market downtrend as the “final shakeout” before Bitcoin reaches its peak in this bull run. Mikybull Crypto also claimed that Bitcoin has a cycle top price target of $171,000, meaning that the flagship crypto will still hit new all-time highs (ATHs) before the bull run was considered as being over.

Featured image from Getty Images, chart from TradingView

Hot Projects

Chainlink Loses 10%, Further Drop To $6.80 Feared | MATIC News

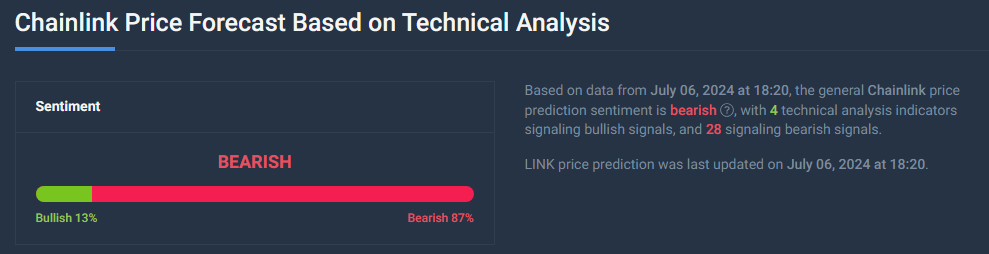

The cryptocurrency market continues its summer swoon, with major coins like Bitcoin tumbling to four-month lows. Chainlink (LINK), a key player in the decentralized oracle network space, has been especially hard-hit, dropping 25% since the beginning of June. But is this a buying opportunity, or the precipice of a steeper decline?

Related Reading

This Chart Pattern Looms Large

Technical analysts are scrutinizing Chainlink’s chart, with a particular focus on the dreaded “Head and Shoulders” pattern. This formation, characterized by a central peak flanked by two smaller ones, often signals a trend reversal from bullish to bearish. Analyst Ali Martinez believes a breach of the neckline, the support level currently hovering around $12.70, could trigger a significant downturn.

#Chainlink $LINK faces a potential 45% price correction if it falls below $12.70! pic.twitter.com/8NGwMzEIhR

— Ali (@ali_charts) July 4, 2024

If LINK falls below $12.70, we could see a cascading sell-off, warns Martinez. This could push the price down to $6.80, a staggering 45% drop. Fibonacci retracement levels, a technical tool used to identify potential support and resistance zones, further bolster this bearish outlook. The 0.786 Fibonacci level aligns perfectly with Martinez’s target of $6.80, lending credence to his prediction.

Bearish Sentiment Grips The Market

Adding fuel to the fire is the overall bearish sentiment gripping the crypto market. The Fear and Greed Index, a measure of investor sentiment, currently sits at a chilling 26, firmly in “Fear” territory. This fear is reflected in LINK’s trading activity. The price is struggling to stay above the critical $12.70 mark, and any decisive break below could accelerate the sell-off.

A Glimmer Of Hope: Oversold Territory And Price Prediction

However, a glimmer of hope remains. The Relative Strength Index (RSI), another technical indicator, suggests LINK might be oversold. The RSI is currently at 28, dipping into “oversold” territory. This could signal a potential short-term bounce, as oversold assets often experience temporary price corrections.

Interestingly, some analysts contradict the prevailing bearish sentiment. Price for LINK is seen increasing 52.73% by August 5th, pushing the price to a healthy $18.97. While technical analysis paints a bleak picture, this prediction offers a counterpoint, highlighting the inherent uncertainty within the crypto market.

Related Reading

The Road Ahead For LINK

Ultimately, the future of Chainlink remains shrouded in uncertainty. Technical indicators scream caution, while some analysts maintain a bullish outlook. The coming weeks will be crucial for Chainlink. Will it defy the bearish whispers and stage a comeback, or succumb to the gravitational pull of a deeper correction?

Featured image from Coldkeepers, chart from TradingView

Hot Projects

Justin Sun Potential $66 Million Loss Revealed As Ethereum Price Declines | MATIC News

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency.

Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems.

In two years of active crypto writing, Semilore has covered multiple aspects of the digital asset space including blockchains, decentralized finance (DeFi), staking, non-fungible tokens (NFT), regulations and network upgrades among others.

In his early years, Semilore honed his skills as a content writer, curating educational articles that catered to a wide audience. His pieces were particularly valuable for individuals new to the crypto space, offering insightful explanations that demystified the world of digital currencies.

Semilore also curated pieces for veteran crypto users ensuring they were up to date with the latest blockchains, decentralized applications and network updates. This foundation in educational writing has continued to inform his work, ensuring that his current work remains accessible, accurate and informative.

Currently at NewsBTC, Semilore is dedicated to reporting the latest news on cryptocurrency price action, on-chain developments and whale activity. He also covers the latest token analysis and price predictions by top market experts thus providing readers with potentially insightful and actionable information.

Through his meticulous research and engaging writing style, Semilore strives to establish himself as a trusted source in the crypto journalism field to inform and educate his audience on the latest trends and developments in the rapidly evolving world of digital assets.

Outside his work, Semilore possesses other passions like all individuals. He is a big music fan with an interest in almost every genre. He can be described as a “music nomad” always ready to listen to new artists and explore new trends.

Semilore Faleti is also a strong advocate for social justice, preaching fairness, inclusivity, and equity. He actively promotes the engagement of issues centred around systemic inequalities and all forms of discrimination.

He also promotes political participation by all persons at all levels. He believes active contribution to governmental systems and policies is the fastest and most effective way to bring about permanent positive change in any society.

In conclusion, Semilore Faleti exemplifies the convergence of expertise, passion, and advocacy in the world of crypto journalism. He is a rare individual whose work in documenting the evolution of cryptocurrency will remain relevant for years to come.

His dedication to demystifying digital assets and advocating for their adoption, combined with his commitment to social justice and political engagement, positions him as a dynamic and influential voice in the industry.

Whether through his meticulous reporting at NewsBTC or his fervent promotion of fairness and equity, Semilore continues to inform, educate, and inspire his audience, striving for a more transparent and inclusive financial future.

-

Hot Projects4 months ago

Hot Projects4 months agoBitcoin Blasts Past $70,000 to Register New All-Time High | MATIC News

-

Latest News4 months ago

Latest News4 months agoCourt upholds SEC’s unregistered securities claims against Gemini, Genesis’ Earn program | MATIC News

-

Latest News2 months ago

Latest News2 months agoSix Coinbase customers claim the exchange is violating securities laws in new lawsuit | MATIC News

-

Hot Projects2 months ago

Bitcoin Will Be Set For New ATHs If It Breaks This Resistance: Analyst | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoBitcoin ETF Inflows Could Eclipse $1 Trillion, Predicts Bitwise CIO | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoOndo Finance Joins BlackRock Tokenized Fund As Inflows Surpass $160M | MATIC News

-

Latest News4 months ago

Latest News4 months agoOver $1 billion wiped off HEX’s valuation following Richard Heart’s disparaging remarks | MATIC News

-

Latest News2 months ago

Latest News2 months agoNew Hampshire representative proposes Bitcoin ETF investment to address state financial liabilities | MATIC News