Latest News

ECB Executive pens November 2025 rollout for digital Euro CBDC | MATIC News

The European Central Bank is pushing ahead with plans to launch a digital euro, aiming to provide a pan-European digital payment solution that complements cash, according to Piero Cipollone, Member of the Executive Board of the ECB. Speaking at the Convegno Innovative Payments conference, Cipollone outlined the fundamental design choices and rationale behind the digital euro project, according to notes released on March 13.

As evolving payment trends reflect people’s increasing preference for digital payments, the ECB seeks to make lives more accessible by offering a public digital means of payment that can be used free of charge for any digital transaction in the euro area. Cipollone emphasized that the digital euro would bring cash-like features to the digital world, being available offline, free for basic use, and respectful of privacy while having a pan-European reach.

However, some critics have raised concerns about the privacy implications of the digital euro. In a recent post, WalkerAmerica, the host of Bitcoin Bitcoin-focused Titcoin Podcast, expressed skepticism about the ECB’s claims of privacy:

“ECB plans to roll out digital Euro CBDC starting in 2025 They claim it’ll be ‘private,’ but it will not be, given Lagarde already wants to throw you in jail for a 1000+ euro anonymous cash payment. Study #Bitcoin & opt out of this totalitarian surveillance token.”

The released slides suggest the digital euro is designed to be accessible to everyone, including individuals and businesses, covering all retail payment scenarios in the euro area wherever digital payments are accepted. Cipollone highlighted the lack of a current European digital means of payment covering all euro area countries, with 13 out of 20 countries relying on international schemes for digital payments, settling 69% of all digital transactions in the EU. The digital euro aims to fill this gap by providing a standardized digital payment platform for the entire euro area.

Addressing inclusivity concerns, Cipollone noted that digital euro payments could also be made using a physical card, with cash being used for funding and defunding. Users would have access to face-to-face technical support and the option to switch intermediaries easily. Selected public entities would also serve as intermediaries for users without bank accounts.

Data protection and privacy are said to be key priorities for the digital euro project. The Eurosystem would implement safeguards to ensure high data protection standards, including internal data segregation and auditing. Innovative privacy-enhancing techniques would be adopted when ready and tested for large payment systems, fostering higher privacy standards for digital euro users.

However, the crypto industry has also been less optimistic about this, with people such as Bitcoin author Quinten Francois commenting that “Cash is anonymous and not censorable. Digital euro isn’t.” Further, in February, Cipollone spoke in front of the European Parliament’s Committee on Economic and Monetary Affairs to allay concerns about the security of the digital euro.

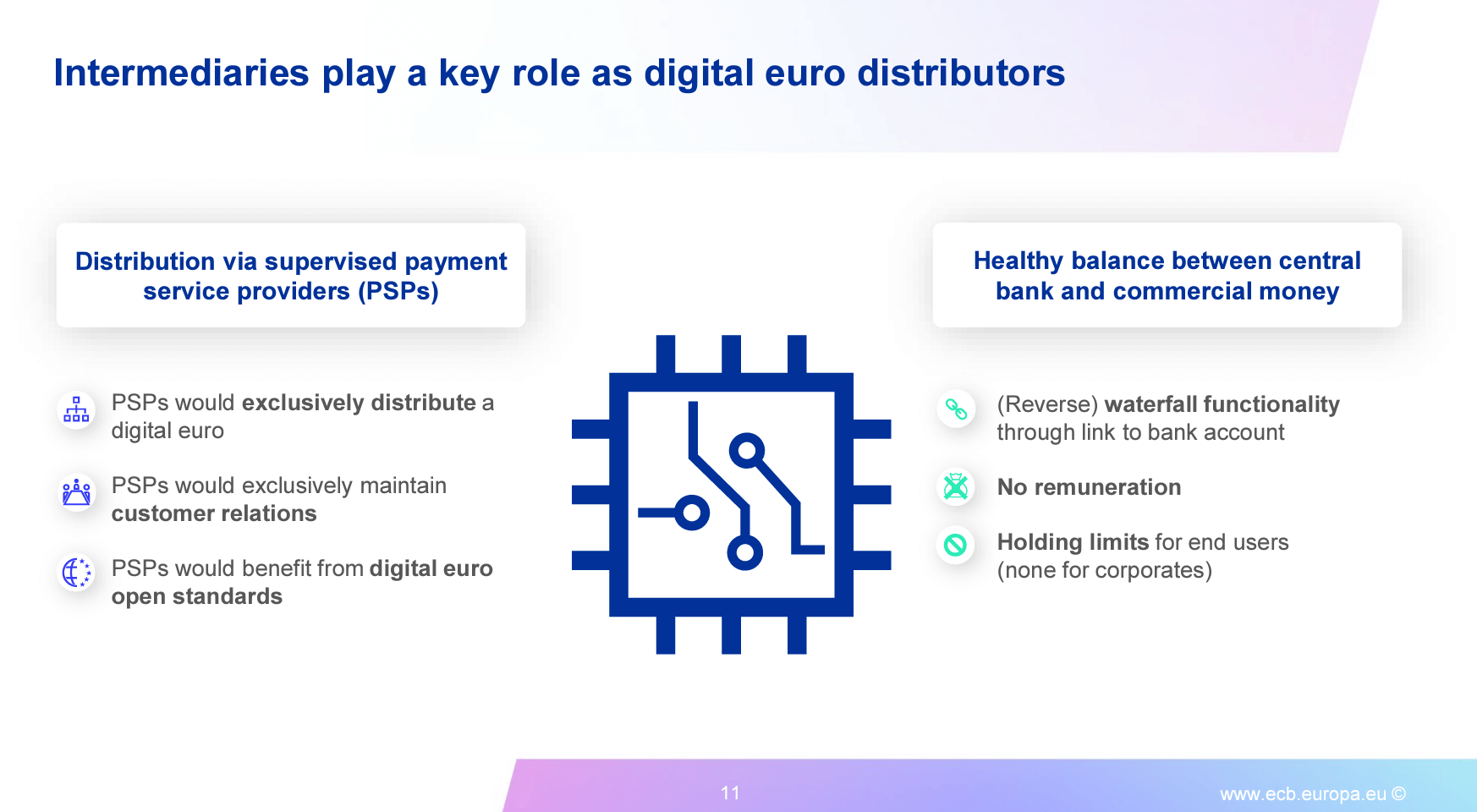

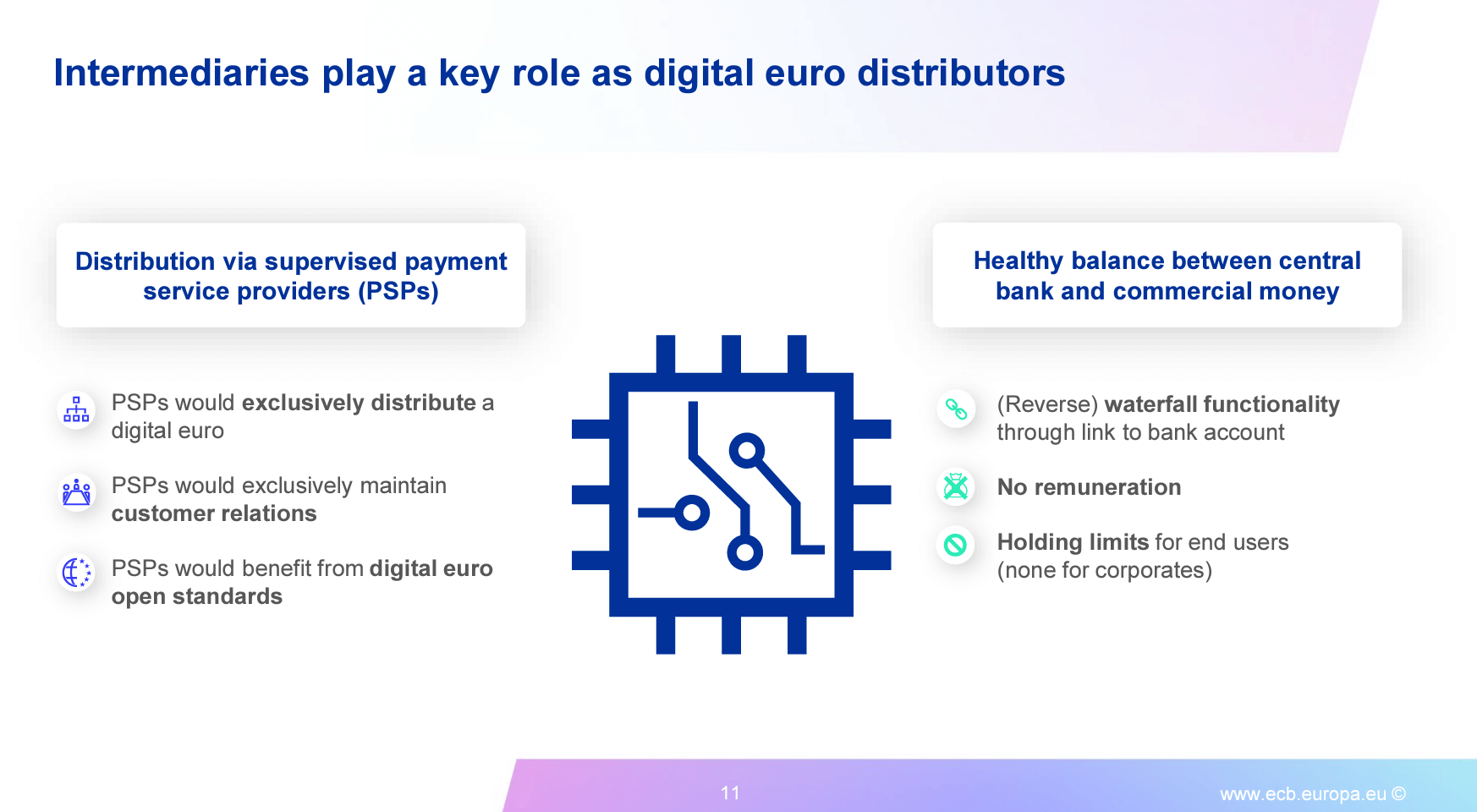

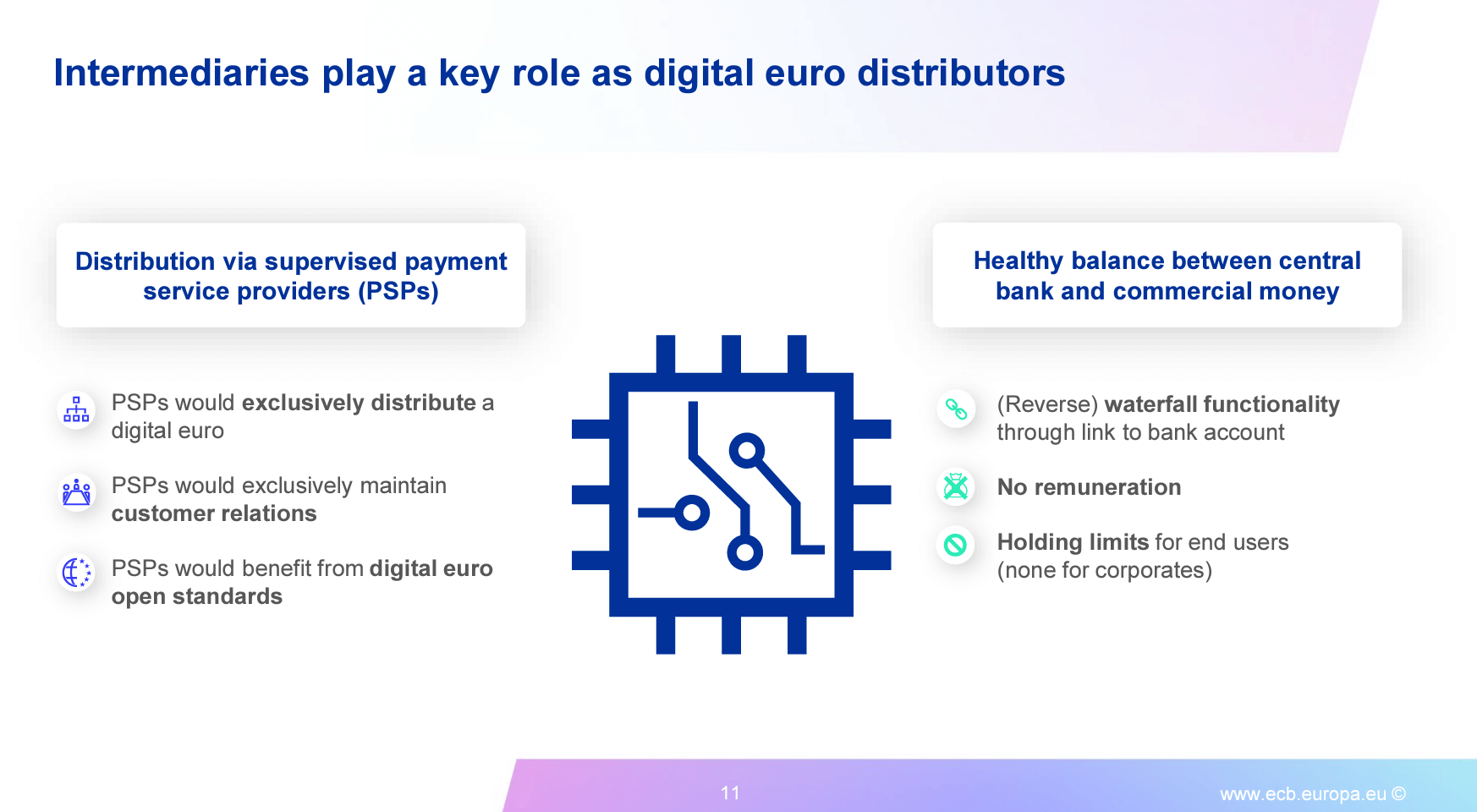

The presentation also asserts that the digital euro would be distributed via supervised payment service providers, maintaining a healthy balance between central bank and commercial money. PSPs would exclusively distribute the digital euro, strengthen customer relations, and benefit from open standards. A digital euro rulebook, drafted with the involvement of market participants, would establish common standards to ensure pan-European reach and a harmonized payment experience while giving the market freedom to develop innovative solutions.

Notably, the above slide showcases how there will be “holding limits” for end users. Still, there are none for “corporates,” suggesting that retail users will have a limit on how much of the digital euro they will be able to custody, but companies will have no limit. Such features aim to create a “healthy balance between central bank and commercial money,” according to the presentation.

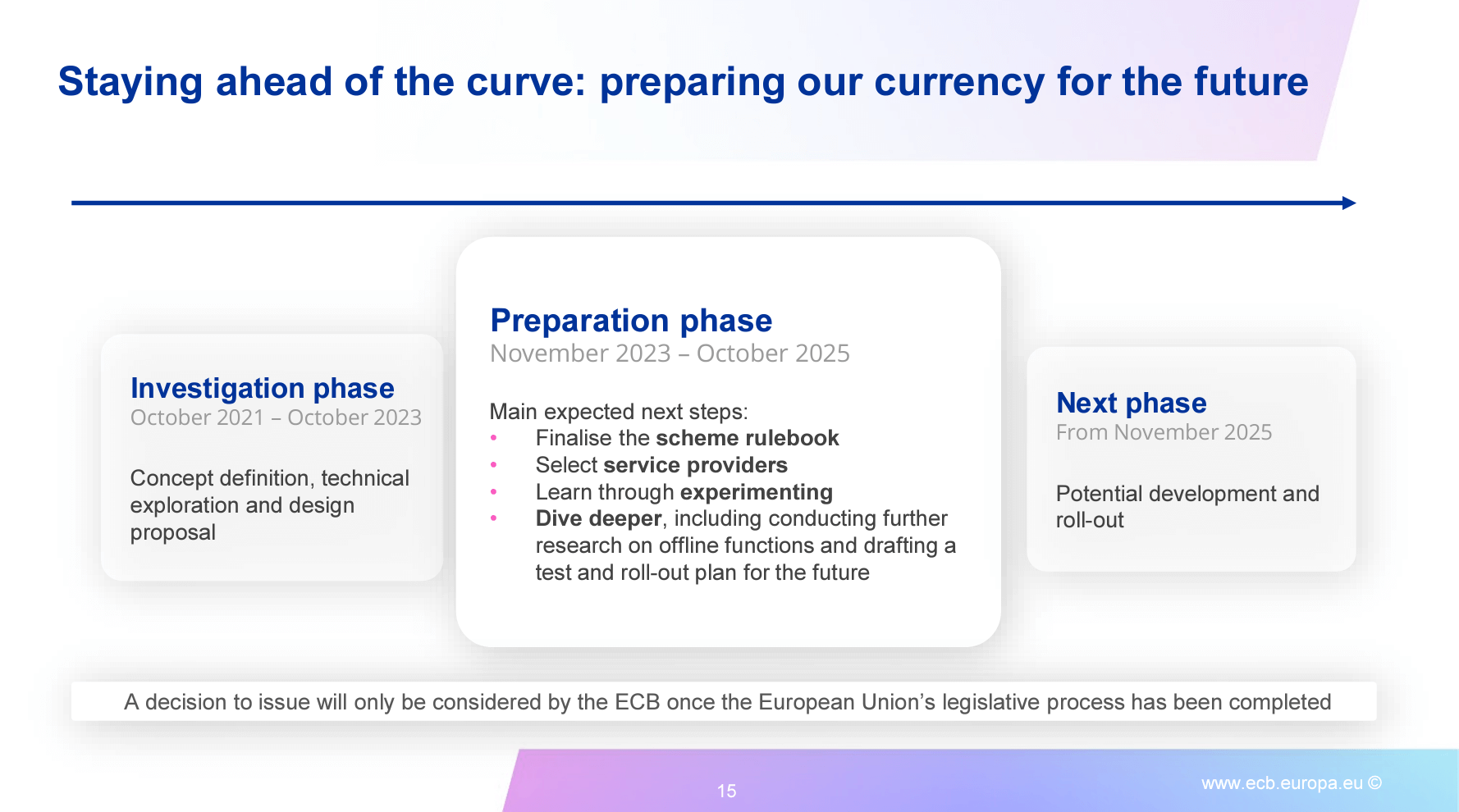

The digital euro project has passed its initial investigation phase (October 2021 – October 2023), focusing on concept definition, technical exploration, and design proposals. The current preparation phase (November 2023 – October 2025) involves finalizing the scheme rulebook, selecting service providers, learning through experimentation, and conducting further research on offline functions and test and rollout plans. A decision to issue the digital euro will only be considered by the ECB once the European Union’s legislative process has been completed. However, the document pens a potential rollout for November 2025.

As the ECB moves forward with its digital euro plans, the debate surrounding privacy and the potential for surveillance continues. Critics like WalkerAmerica urge individuals to study Bitcoin and opt out of what they perceive as a “totalitarian surveillance token.” The ECB will need to address these concerns and provide explicit assurances regarding data protection and user privacy to gain widespread acceptance of the digital euro.

Latest News

Crypto VC investment ‘continued rebound’ in Q2 with $3.2 billion invested – Galaxy | MATIC News

Venture capital investments in crypto continued to rebound in the second quarter, with a total $3.2 billion invested during the period — up 28% compared to $2.5 billion in the previous quarter, according to Galaxy Digital latest research report.

The report also identified a 94% quarterly surge in median pre-money valuation, which rose to $37 million from $19 million in the first quarter.

Galaxy noted the second quarter’s median pre-money valuation is the highest since the fourth quarter of 2021 and represents an almost all-time high. It attributed the surge to a more competitive market, giving companies greater negotiation leverage in deals.

Meanwhile, the second quarter median deal size grew to $3.2 million from $3 million, up 7% after remaining largely steady for five quarters. Deal count fell to 577 in the second quarter, down from 603 in the first quarter but up from less than 400 in the fourth quarter of 2023.

According to the report:

“Despite a lack of available investment capital compared to previous peaks, the resurgence of the crypto market… is leading to significant competition and [FOMO] among investors.”

The report highlighted a positive shift in crypto venture capital sentiment, buoyed by a nearly 50% year-to-date rise in Bitcoin and Ethereum prices. If the trend continues, 2024 will have the third-highest investment capital and deal count numbers after the bull markets of 2021 and 2022.

However, the report also noted that despite Bitcoin experiencing a significant rise since January 2023, venture capital activity has not kept pace, trading well below the levels seen when the flagship crypto last traded above $60,000 in 2021 and 2022.

The divergence is attributed to several factors, including crypto-native catalysts like Bitcoin ETFs and emerging areas such as restaking and Bitcoin Layer 2 solutions. Additionally, pressures from crypto startup bankruptcies, regulatory challenges, and macroeconomic headwinds, particularly interest rates, have collectively contributed to the breakdown.

Other data and trends

Specific project categories led fundraising — including Web3, which brought in $758 million or 24% of all capital. Infrastructure brought in over $450 million (15%), trading and exchanges brought in under $400 million (12%), and Layer 1 brought in under $400 million (12%).

Bitcoin Layer 2 networks continued to see significant investments of $94.6 million, up 174% on a quarterly basis. Galaxy said “investor excitement remains high” around the possibility of composable blockspace attracting DeFi and NFT projects to Bitcoin.

US companies dominated VC investment, attracting 53% of all capital and 40% of deals. Galaxy said US dominance exists despite regulatory change that could cause companies to leave the country and warned policymakers to be aware of their impact.

Early-stage firms received about 78% of capital, while late-stage companies received 20% of all capital. Galaxy said that larger general VC firms have left the sector or scaled down their activity, reducing the ability of later-stage startups to raise money.

Mentioned in this article

Latest News

Bittensor proposes burning 10% supply to stabilize TAO following $8 million exploit | MATIC News

OpenTensor Foundation (OTF) has proposed burning 10% of the Bitttensor (TAO) supply to stabilize the token’s price in response to a recent exploit that led to the loss of $8 million worth of the tokens.

The decentralized AI network has put forward a vote for users to decide on the burn. Active voters participating in the proposal will be rewarded with compensatory DAO rewards at a later date.

The exploit, which occurred on July 2, saw a Bittensor user lose 32,000 TAO tokens due to a leaked private key. The incident caused an immediate 15% drop in TAO’s price, hitting a six-month low of $227. The price has since rebounded slightly to $240.

Attack timeline

The attack timeline reveals that the incident began on July 2 at 7:06 P.M. UTC when funds started being transferred out of wallets.

OTF detected the abnormal transfer volume and initiated a war room by 7:25 P.M. UTC, and by 7:41 P.M. UTC, the team had neutralized the attack by placing validators behind a firewall and activating safe mode to prevent nodes from connecting to the chain.

During this period, the network was configured to only produce blocks, halting all transactions to prevent further losses and allowing time for a thorough investigation.

The root cause of the attack was traced back to a malicious package in the PyPi Package Manager version 6.12.2, which compromised user security. The package, posing as a legitimate Bittensor package, contained code designed to steal unencrypted coldkey details.

When users downloaded this package and decrypted their coldkeys, the decrypted bytecode was sent to a remote server controlled by the attacker.

The incident prompted an immediate response from the OTF team, which prioritized the security breach over regular updates and maintenance. The disruption has been a significant test for the network, highlighting both its vulnerabilities and the resilience of its infrastructure.

Aftermath

Despite the severity of the attack, some validators, such as RoundTable 21, confirmed that their delegators’ funds remained secure, emphasizing that the exploit did not impact all users uniformly.

However, the decision to halt the chain has led to a debate within the community about its implications for Bittensor’s claim of decentralization. Critics argue that the ability to pause the chain contradicts the principles of a decentralized AI network, while supporters believe it was necessary to protect users’ assets.

OTF plans to gradually resume normal operations of the Bittensor blockchain, ensuring a safe and responsible approach. Regular progress updates will be provided to the community.

As a precaution, users who suspect their wallets were compromised are advised to create new wallets and transfer their funds once the blockchain resumes normal operation. Additionally, upgrading to the latest version of Bittensor is strongly recommended.

Moving forward, Bittensor will implement enhanced package verification processes, increase the frequency of security audits, adopt best practices in public security policies, and improve monitoring and logging of package uploads and downloads.

The proposed token burn and ongoing security enhancements aim to restore confidence in the TAO ecosystem. The outcome of the vote will play a crucial role in stabilizing and securing the network, with the community eagerly awaiting further updates from the developers.

Mentioned in this article

Latest News

Europe’s largest Bitcoin miner Northern Data to launch IPO in the US | MATIC News

Europe’s largest Bitcoin miner, Northern Data AG, has announced plans for a substantial initial public offering (IPO) in the US at a valuation between $10 billion and $16 billion.

The IPO, which will be held on the Nasdaq stock exchange, is scheduled for the first half of 2025 and may also include selling a minority stake to investors prior to the public listing.

Following the IPO announcement, Northern Data’s shares on the XETRA stock exchange surged by over 5%, reaching €25. This positive market reaction indicates strong investor confidence in the company’s future prospects. The firm first considered an IPO in 2021 but decided against it at the time.

The upcoming offering will highlight two of Northern Data’s key business units: Taiga, which handles the company’s cloud computing activities, and Ardent, which manages its data centers. Both units are crucial to Northern Data’s strategy to capitalize on the rapidly expanding AI sector.

The crypto industry continues to face regulatory challenges. Previous attempts by digital asset firms to go public, including Circle, encountered difficulties due to regulatory scrutiny. However, Northern Data’s focus on AI and cloud computing may help it navigate these challenges more effectively.

AI pivot

Originally founded as Northern Bitcoin AG, Northern Data has grown into a significant player in the Bitcoin mining industry. In recent years, the company has diversified its operations to include artificial intelligence (AI) and cloud computing, responding to the decreasing profitability of Bitcoin mining and the growing opportunities in these fields.

In November 2023, Northern Data secured $610 million in debt financing from Tether. The investment is intended to strengthen Northern Data’s AI and cloud computing operations.

The financing followed a strategic partnership between the two companies announced in September 2023. The partnership aimed to focus on AI, peer-to-peer communications, and data storage solutions.

Northern Data’s pivot towards AI and cloud computing reflects a broader industry trend. As the profitability of Bitcoin mining declines, many companies, including Core Scientific and Hut 8 Corp, are exploring new revenue streams.

Committed to Bitcoin mining

While diversifying its business, Northern Data remains committed to Bitcoin mining and plans to continue expanding its footprint in the industry.

Peak Mining, the company’s US-based Bitcoin mining unit, is a significant part of its operations, with nearly 700 megawatts of high-performance computing data centers. In 2023, Peak Mining mined 2,298 BTC, generating over $64 million in revenue despite an 18% year-over-year decrease in production.

Northern Data’s presence in the US has been growing steadily. In May, the company acquired its second 300-megawatt mining site, further solidifying its position in the American market. The expansion highlights Northern Data’s long-term commitment to Bitcoin mining, even as it explores new technological frontiers.

Mentioned in this article

-

Hot Projects4 months ago

Hot Projects4 months agoBitcoin Blasts Past $70,000 to Register New All-Time High | MATIC News

-

Latest News4 months ago

Latest News4 months agoCourt upholds SEC’s unregistered securities claims against Gemini, Genesis’ Earn program | MATIC News

-

Hot Projects2 months ago

Bitcoin Will Be Set For New ATHs If It Breaks This Resistance: Analyst | MATIC News

-

Latest News2 months ago

Latest News2 months agoSix Coinbase customers claim the exchange is violating securities laws in new lawsuit | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoBitcoin ETF Inflows Could Eclipse $1 Trillion, Predicts Bitwise CIO | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoOndo Finance Joins BlackRock Tokenized Fund As Inflows Surpass $160M | MATIC News

-

Latest News4 months ago

Latest News4 months agoOver $1 billion wiped off HEX’s valuation following Richard Heart’s disparaging remarks | MATIC News

-

Latest News2 months ago

Latest News2 months agoNew Hampshire representative proposes Bitcoin ETF investment to address state financial liabilities | MATIC News