Hot Projects

Toncoin (TON) Hits New Yearly Peaks, Surging 60% On Buzz Surrounding Potential Telegram IPO | MATIC News

Toncoin (TON) has experienced a notable uptrend in recent weeks, driven by significant news and announcements surrounding the popular social media platform Telegram, the latest being a potential initial public offering (IPO).

Telegram User Base Surpasses 900 Million

According to his latest appearance, aside from his constant announcements through his channel on the social media platform, Pavel Durov, the CEO of Telegram, shared that the messaging app has amassed over 900 million users, up from 500 million in 2021, and is steadily approaching profitability.

In an interview with the Financial Times, Durov revealed that Telegram’s introduction of advertising and premium subscription services two years ago has enabled the company to generate “hundreds of millions of dollars” in revenues. With yearly expenses at less than 70 cents per monthly user, Telegram’s financial growth is gaining momentum.

Telegram is implementing various strategies as part of its ongoing efforts to generate revenue. As reported by NewsBTC, the company is planning to introduce revenue sharing with channel creators, offering them a 50% share of the marketing budget.

Additionally, Telegram is launching business accounts and a “social discovery” feature, which will reportedly facilitate user interaction and help connect individuals nearby. These initiatives aim to diversify Telegram’s revenue streams and provide additional value to its user base.

Potential Valuation Exceeds $30 Billion

Telegram has reportedly garnered significant interest from potential investors, with offers exceeding $30 billion in valuation. However, during the interview with the Financial Times, Durov emphasized that the company’s priority is to remain independent, and an IPO would serve as a means to “democratize” access to Telegram’s value. Durov stated:

The main reason why we started to monetize is because we wanted to remain independent. Generally speaking, we see value in [an IPO] as a means to democratize access to Telegram’s value.

While Durov did not provide a specific timeline or venue for the potential IPO, two people familiar with the matter told the Financial Times that Telegram may pursue a US listing once profitability is achieved and market conditions are favorable.

Notably, the messaging app platform has already raised approximately $2 billion in debt financing through bond offerings, providing flexibility for future financial decisions.

In the event of an IPO, Telegram is considering selling an allocation of stock to loyal users, similar to Reddit’s recent announcement. This approach aims to involve the community and foster a sense of ownership.

Furthermore, Telegram is exploring the possibility of a smaller equity raise to fuel its artificial intelligence (AI) ambitions, including introducing an AI-powered chatbot. The company also plans to enhance its moderation processes and deploy AI-related mechanisms to address potential issues, particularly during global elections.

TON Climbs The Ranks

With Telegram’s endorsement and integration of TON into the app’s user interface and introducing a new ad revenue-sharing system, Toncoin has surged 97% in the past month, marking new yearly highs for the token.

In addition, Telegram’s potential initial public offering has further bolstered Toncoin’s upward trajectory, with a 20% spike in the past 24 hours, resulting in a current trading price of $4.40.

On top of that, TON has climbed into the top 13 largest cryptocurrencies on the market with a capitalization of $15 billion, surpassing other major coins such as Polkadot (DOT), Polygon (MATIC) and Chainlink (LINK).

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Hot Projects

Chainlink Loses 10%, Further Drop To $6.80 Feared | MATIC News

The cryptocurrency market continues its summer swoon, with major coins like Bitcoin tumbling to four-month lows. Chainlink (LINK), a key player in the decentralized oracle network space, has been especially hard-hit, dropping 25% since the beginning of June. But is this a buying opportunity, or the precipice of a steeper decline?

Related Reading

This Chart Pattern Looms Large

Technical analysts are scrutinizing Chainlink’s chart, with a particular focus on the dreaded “Head and Shoulders” pattern. This formation, characterized by a central peak flanked by two smaller ones, often signals a trend reversal from bullish to bearish. Analyst Ali Martinez believes a breach of the neckline, the support level currently hovering around $12.70, could trigger a significant downturn.

#Chainlink $LINK faces a potential 45% price correction if it falls below $12.70! pic.twitter.com/8NGwMzEIhR

— Ali (@ali_charts) July 4, 2024

If LINK falls below $12.70, we could see a cascading sell-off, warns Martinez. This could push the price down to $6.80, a staggering 45% drop. Fibonacci retracement levels, a technical tool used to identify potential support and resistance zones, further bolster this bearish outlook. The 0.786 Fibonacci level aligns perfectly with Martinez’s target of $6.80, lending credence to his prediction.

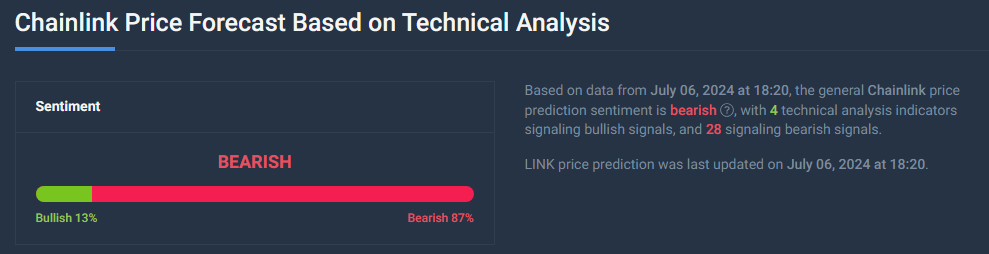

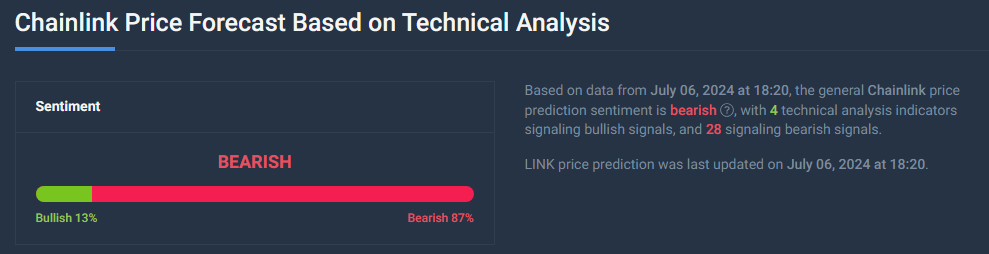

Bearish Sentiment Grips The Market

Adding fuel to the fire is the overall bearish sentiment gripping the crypto market. The Fear and Greed Index, a measure of investor sentiment, currently sits at a chilling 26, firmly in “Fear” territory. This fear is reflected in LINK’s trading activity. The price is struggling to stay above the critical $12.70 mark, and any decisive break below could accelerate the sell-off.

A Glimmer Of Hope: Oversold Territory And Price Prediction

However, a glimmer of hope remains. The Relative Strength Index (RSI), another technical indicator, suggests LINK might be oversold. The RSI is currently at 28, dipping into “oversold” territory. This could signal a potential short-term bounce, as oversold assets often experience temporary price corrections.

Interestingly, some analysts contradict the prevailing bearish sentiment. Price for LINK is seen increasing 52.73% by August 5th, pushing the price to a healthy $18.97. While technical analysis paints a bleak picture, this prediction offers a counterpoint, highlighting the inherent uncertainty within the crypto market.

Related Reading

The Road Ahead For LINK

Ultimately, the future of Chainlink remains shrouded in uncertainty. Technical indicators scream caution, while some analysts maintain a bullish outlook. The coming weeks will be crucial for Chainlink. Will it defy the bearish whispers and stage a comeback, or succumb to the gravitational pull of a deeper correction?

Featured image from Coldkeepers, chart from TradingView

Hot Projects

Justin Sun Potential $66 Million Loss Revealed As Ethereum Price Declines | MATIC News

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency.

Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems.

In two years of active crypto writing, Semilore has covered multiple aspects of the digital asset space including blockchains, decentralized finance (DeFi), staking, non-fungible tokens (NFT), regulations and network upgrades among others.

In his early years, Semilore honed his skills as a content writer, curating educational articles that catered to a wide audience. His pieces were particularly valuable for individuals new to the crypto space, offering insightful explanations that demystified the world of digital currencies.

Semilore also curated pieces for veteran crypto users ensuring they were up to date with the latest blockchains, decentralized applications and network updates. This foundation in educational writing has continued to inform his work, ensuring that his current work remains accessible, accurate and informative.

Currently at NewsBTC, Semilore is dedicated to reporting the latest news on cryptocurrency price action, on-chain developments and whale activity. He also covers the latest token analysis and price predictions by top market experts thus providing readers with potentially insightful and actionable information.

Through his meticulous research and engaging writing style, Semilore strives to establish himself as a trusted source in the crypto journalism field to inform and educate his audience on the latest trends and developments in the rapidly evolving world of digital assets.

Outside his work, Semilore possesses other passions like all individuals. He is a big music fan with an interest in almost every genre. He can be described as a “music nomad” always ready to listen to new artists and explore new trends.

Semilore Faleti is also a strong advocate for social justice, preaching fairness, inclusivity, and equity. He actively promotes the engagement of issues centred around systemic inequalities and all forms of discrimination.

He also promotes political participation by all persons at all levels. He believes active contribution to governmental systems and policies is the fastest and most effective way to bring about permanent positive change in any society.

In conclusion, Semilore Faleti exemplifies the convergence of expertise, passion, and advocacy in the world of crypto journalism. He is a rare individual whose work in documenting the evolution of cryptocurrency will remain relevant for years to come.

His dedication to demystifying digital assets and advocating for their adoption, combined with his commitment to social justice and political engagement, positions him as a dynamic and influential voice in the industry.

Whether through his meticulous reporting at NewsBTC or his fervent promotion of fairness and equity, Semilore continues to inform, educate, and inspire his audience, striving for a more transparent and inclusive financial future.

Hot Projects

Analyst Forecasts $44,000 Plunge On 200 Daily EMA Breakdown | MATIC News

The cryptocurrency market witnessed a significant setback as the Bitcoin price plummeted below the $58,000 level. This downward move has raised concerns among bullish investors, suggesting a potential continuation of the downtrend toward the $44,000 support level.

Bitcoin’s failure to consolidate above and retest its all-time high (ATH) of $73,700, reached in March, has resulted in a retracement of over 20% on the monthly time frame.

Bitcoin Price At Risk

Crypto analyst “Blockchaineddbb” has provided a noteworthy assessment of the situation. According to the analysis, a daily close below the 200 daily exponential-moving average (EMA), currently positioned at $58,000, indicates a strong likelihood of Bitcoin’s price dropping to $44,000.

The analyst cautions against waiting for a bounce after the daily close below the 200 daily EMA, emphasizing the historical significance of such a breach.

Related Reading

Blockchaineddbb’s analysis reveals the historical impact of losing the 200 daily EMA. Each time Bitcoin experienced this loss, its price declined by an average of 30%, with losses ranging from 8% to 50%.

The breach of the 200 daily EMA signifies Bitcoin entering an unsafe territory, heightening investor concerns. To mitigate potential losses, the analyst suggests considering an exit point before the expected further decline to $50,000, which is the next significant support level.

Navigating The Bearish Storm

Blockchaineddbb provides average support levels to consider during the bearish sentiment for those who choose to hold their positions.

These levels are estimated at $50,000, $48,000, and $44,000, with the latter being the worst-case scenario. Long-term holders are advised to adhere to their planned averaging strategy, which involves accumulating positions on specific dates such as June 22, September 22, and December 22.

According to the analyst, the target exit price remains at $75,000, with expectations of achieving this milestone by December.

Considering various factors, such as a predicted September dump, the Mt. Gox settlement deadline, and upcoming elections, the analyst suggested that the prevailing bearish sentiment will persist until December.

Related Reading

Ultimately, if the current bearish sentiment continues, altcoins are expected to suffer losses until the year’s end. It is worth noting that a potential shift in this scenario would only occur if Bitcoin manages to close above the 200 Daily EMA. However, the probability of that happening appears low.

Currently, the Bitcoin price stands at $56,435, just below the critical $58,000 EMA, after falling as low as $53,500 in the early hours of Friday trading.

Featured image from DALL-E, chart from TradingView.com

-

Hot Projects4 months ago

Hot Projects4 months agoBitcoin Blasts Past $70,000 to Register New All-Time High | MATIC News

-

Latest News4 months ago

Latest News4 months agoCourt upholds SEC’s unregistered securities claims against Gemini, Genesis’ Earn program | MATIC News

-

Latest News2 months ago

Latest News2 months agoSix Coinbase customers claim the exchange is violating securities laws in new lawsuit | MATIC News

-

Hot Projects2 months ago

Bitcoin Will Be Set For New ATHs If It Breaks This Resistance: Analyst | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoBitcoin ETF Inflows Could Eclipse $1 Trillion, Predicts Bitwise CIO | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoOndo Finance Joins BlackRock Tokenized Fund As Inflows Surpass $160M | MATIC News

-

Latest News4 months ago

Latest News4 months agoOver $1 billion wiped off HEX’s valuation following Richard Heart’s disparaging remarks | MATIC News

-

Latest News2 months ago

Latest News2 months agoNew Hampshire representative proposes Bitcoin ETF investment to address state financial liabilities | MATIC News