Hot Projects

German Gov’t Sells Amother $67 M In Bitcoin Amid Market Woes | MATIC News

In a continued effort to liquidate its substantial Bitcoin holdings, the German government has once again engaged in significant transactions involving BTC, according to data from blockchain analytics platforms Arkham Intel. This morning, the Federal Criminal Police Office (BKA) executed nine transactions involving a total of roughly 2,786 BTC.

German Gov’t Continues Its Bitcoin Sell-Off

Arkham Intel’s data shows that four of them are internal transfers while five transactions were direct transfers to crypto exchanges and market makers, suggesting an intent to sell. The five potential sales amount to 1,095.339 BTC worth approximately $67 million. Specifically, the BKA made two 125 BTC transfers, each worth approximately $7.7 million, to well-known crypt exchanges Bitstamp and Kraken.

An additional transaction involved a minute test transfer of 0.001 BTC to Flow Traders, a leading market maker. This small transaction was soon followed by a much larger transfer of 345.338 BTC to the same entity, strongly suggesting preparation for a substantial sell order.

Related Reading

Another noteworthy transfer of 500 BTC was directed to an enigmatic address tagged as “139Po.” This address has seen previous activity linked to the German government but remains shrouded in mystery, speculated to be another sale point.

These transactions form part of a broader trend observed since last week. Just a day prior, on June 25, the government had disposed of 400 Bitcoin worth $24 million on Kraken and Coinbase, as well as 500 BTC to address “139Po.”

This is in addition to significant movements earlier last week: $130 million worth of BTC were transferred to exchanges on June 19 and $65 million on June 20. Counterbalancing these outflows, the government received $20.1 million back from Kraken and $5.5 million from wallets associated with Robinhood, Bitstamp, and Coinbase.

Related Reading

Currently, the German government’s holdings amount to 45,264 BTC, valued at around $2.8 billion. This makes Germany one of the top nation-state holders of Bitcoin, trailing only behind the United States, China, and the United Kingdom, which hold 213,246 BTC, 190,000 BTC, and 61,000 BTC respectively, according to data from Bitcoin Treasuries.

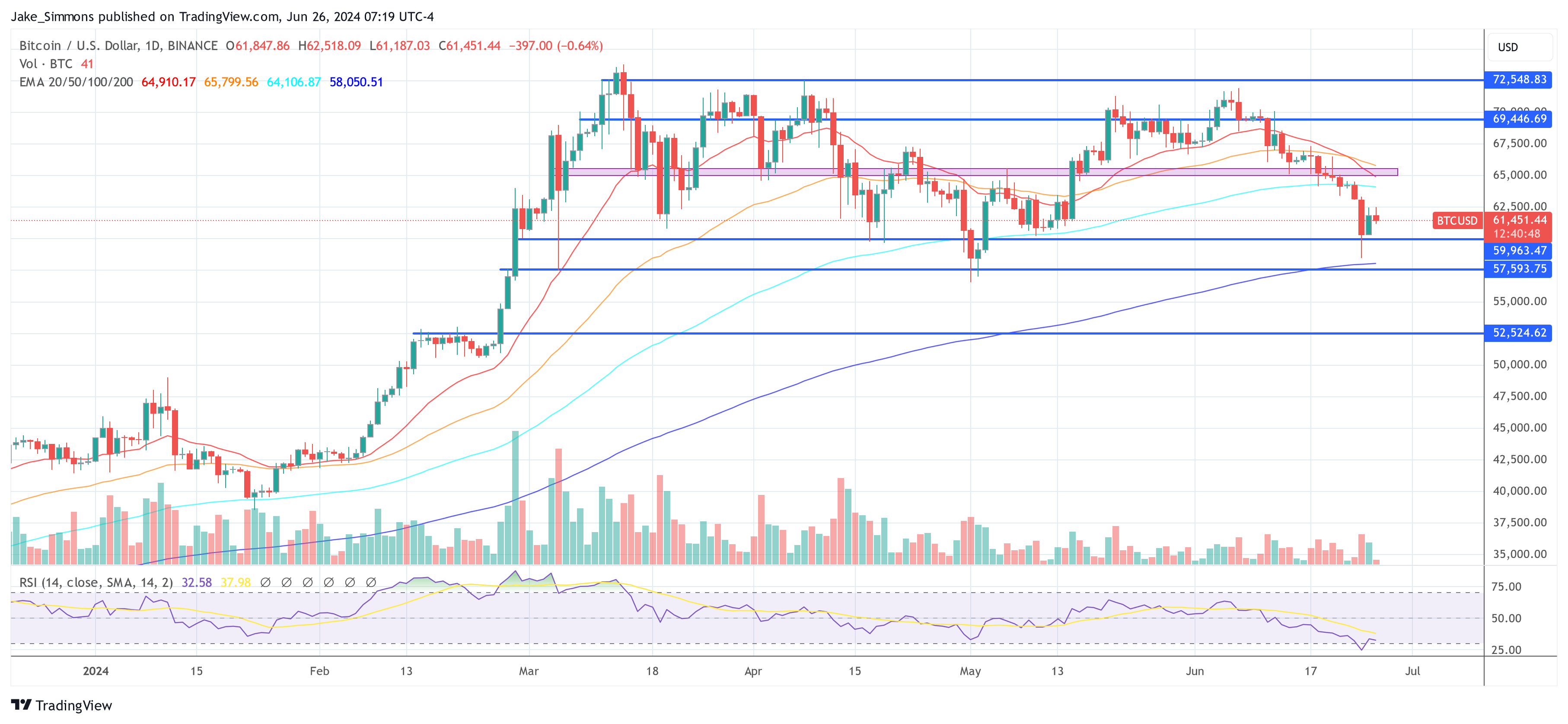

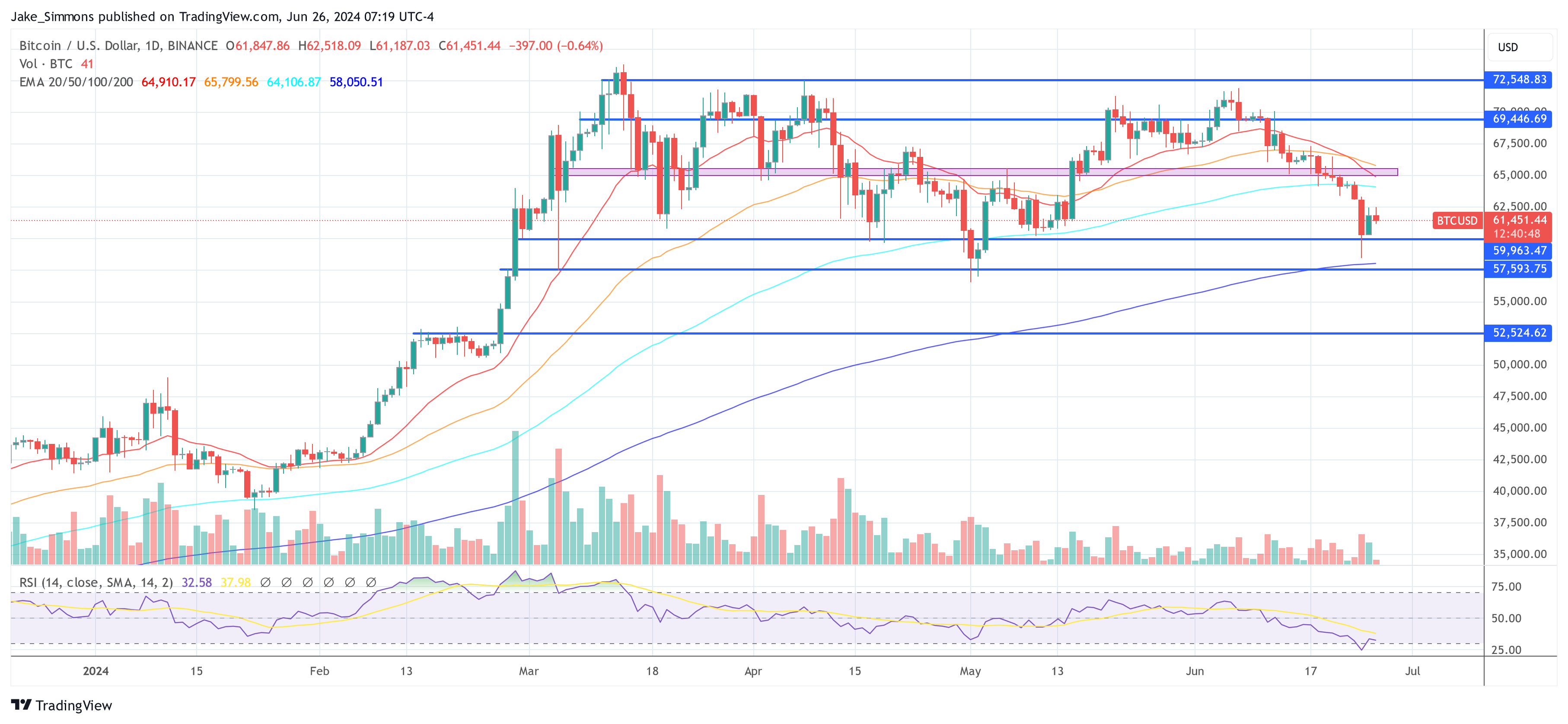

BTC Price Hangs Above Critical Level

The pattern of large-scale disposals by the German government has contributed to fluctuations in Bitcoin’s market price, which has experienced a decline of approximately 6% since the onset of these transactions. Bitcoin’s value briefly fell below the $60,000 threshold following the announcement from Mt. Gox about disbursing approximately $9 billion worth of Bitcoin and Bitcoin Cash starting in July.

Market analysts and investors are also keenly observing these governmental actions as the sell-off seems to continue at a slow pace. This strategic liquidation by the German government arrives at a pivotal juncture for market sentiment, with Bitcoin prices teetering just above critical support levels. Should the daily trading price close below the $60,000 threshold, it could potentially trigger a more pronounced downturn in Bitcoin’s price, exacerbating market volatility and uncertainty.

At press time, BTC traded at $61,451.

Featured image created with DALL·E, chart from TradingView.com

Hot Projects

Avalanche Gains Momentum As AVAX Sets Sights On $30.34 Resistance | MATIC News

My name is Godspower Owie, and I was born and brought up in Edo State, Nigeria. I grew up with my three siblings who have always been my idols and mentors, helping me to grow and understand the way of life.

My parents are literally the backbone of my story. They’ve always supported me in good and bad times and never for once left my side whenever I feel lost in this world. Honestly, having such amazing parents makes you feel safe and secure, and I won’t trade them for anything else in this world.

I was exposed to the cryptocurrency world 3 years ago and got so interested in knowing so much about it. It all started when a friend of mine invested in a crypto asset, which he yielded massive gains from his investments.

When I confronted him about cryptocurrency he explained his journey so far in the field. It was impressive getting to know about his consistency and dedication in the space despite the risks involved, and these are the major reasons why I got so interested in cryptocurrency.

Trust me, I’ve had my share of experience with the ups and downs in the market but I never for once lost the passion to grow in the field. This is because I believe growth leads to excellence and that’s my goal in the field. And today, I am an employee of Bitcoinnist and NewsBTC news outlets.

My Bosses and co-workers are the best kinds of people I have ever worked with, in and outside the crypto landscape. I intend to give my all working alongside my amazing colleagues for the growth of these companies.

Sometimes I like to picture myself as an explorer, this is because I like visiting new places, I like learning new things (useful things to be precise), I like meeting new people – people who make an impact in my life no matter how little it is.

One of the things I love and enjoy doing the most is football. It will remain my favorite outdoor activity, probably because I’m so good at it. I am also very good at singing, dancing, acting, fashion and others.

I cherish my time, work, family, and loved ones. I mean, those are probably the most important things in anyone’s life. I don’t chase illusions, I chase dreams.

I know there is still a lot about myself that I need to figure out as I strive to become successful in life. I’m certain I will get there because I know I am not a quitter, and I will give my all till the very end to see myself at the top.

I aspire to be a boss someday, having people work under me just as I’ve worked under great people. This is one of my biggest dreams professionally, and one I do not take lightly. Everyone knows the road ahead is not as easy as it looks, but with God Almighty, my family, and shared passion friends, there is no stopping me.

Hot Projects

SEC Serves Fresh Lawsuit To Metamask Developer Consensys | MATIC News

The US Securities and Exchange Commission (SEC) has instituted a lawsuit against Metamask developer, Consensys. The Commission alleges that the crypto firm violated securities laws by acting as an unregistered securities broker.

Related Reading

SEC Accuses Consensys Of Violating Securities Laws Using Metamask

According to the court document, the SEC claims that Consensys has acted “as an unregistered broker of crypto asset securities through its MetaMask Swaps service” since October 2020. The Commission also accused the crypto firm of engaging in the unregistered offer and sale of securities through crypto staking programs.

The SEC stated that Consensys has brokered over 36 million crypto transactions since 2020 through its MetaMask Swaps, at least 5 million involving crypto asset securities. Metamask is known as one of the most widely used crypto wallets. In addition to storing their crypto assets on the application, users can buy and sell cryptocurrencies by swapping one crypto asset for the other.

This ‘Swap’ service forms the focal point of the SEC’s enforcement action. The SEC claims that some of these crypto assets are securities, and by enabling users to swap these securities, Consensys acted as an unregistered securities broker, thereby violating securities laws in the process.

The SEC went further to list Polygon (MATIC), Decentraland (MANA), Chiliz (CHZ), The Sandbox (SAND), and Luna (LUNA) as the crypto securities that were made available for trading on Metamask’s swap platform.

Additionally, the SEC accused Consensys of performing a “traditional function of the securities market” by offering and selling securities for Lido and Rocket Pool. The Commission claimed that the staking programs offered by Lido and Rocket Poo are investment contracts and that Consensys was in the wrong by offering these securities through unregistered transactions on its ‘MetaMask Staking’ platform.

The Genesis Of The Legal Battle Between SEC And Consensys

Interestingly, the SEC’s lawsuit against Consensys comes just months after the crypto firm filed a lawsuit against the Commission, accusing the SEC of an “unlawful seizure of authority.” Consensys sought Judicial relief against a potential action from the SEC. They also asked the court to declare that Ethereum wasn’t a security and that the SEC had no jurisdiction over crypto-related matters.

The crypto firm looked to have won that battle, considering that the SEC dropped its investigation into Ethereum’s status as a security. However, in the letters informing Consensys about the Commission’s decision to drop its investigation into Ethereum, the SEC had warned the crypto firm that they could bring enforcement actions against them relating to other issues, which they have now done.

Related Reading

Reacting to the SEC’s lawsuit, Consensys stated that it would “vigorously pursue” the lawsuit it had initially filed against the SEC. The crypto firm also remarked that they had fully expected” the SEC to follow through with its threat of claiming that MetaMask had to be registered as a securities broker.

Featured image from CNBC, chart from TradingView

Hot Projects

Analyst Bullish On Crypto’s 240% Rally | MATIC News

The cryptocurrency market has been a rollercoaster ride in 2024, with many tokens experiencing significant losses. However, amidst the chaos, XRP, the native token of Ripple, has stood out as a beacon of stability. While not immune to the overall market dip, XRP has remained relatively range-bound, minimizing losses and sparking renewed optimism among analysts and investors alike.

Related Reading

Stability Breeds Bullish Sentiment

While Bitcoin and Ethereum have taken significant hits this year, XRP has displayed remarkable resilience. This stability is attributed to several factors, including its utility-driven nature. The altcoin is designed to facilitate faster and cheaper cross-border transactions, a function that remains valuable regardless of market sentiment. Additionally, Ripple’s ongoing partnerships with financial institutions continue to provide a level of stability for the token.

The coin’s recent performance is a testament to its underlying strength. The token’s ability to hold its ground during a bearish market suggests it has a strong foundation and could be well-positioned for future growth.

Analyst Predicts 240% Surge Against Bitcoin

Adding fuel to the bullish fire, prominent crypto analyst Javon Marks has made a bold prediction for XRP. Marks, known for his accurate forecasts, believes the crypto is on the cusp of a major breakout against Bitcoin.

$XRP / #BTC has, on a Logarithmic Scale, broken out of a notable, near year long resisting trend and this can be a sign of a major bullish reversal to come in.

With this breakout, a follow through can result in XRP outrunning Bitcoin by more than 243%!

In Mid 2023, XRP moved… pic.twitter.com/84Aqlp3rLI

— JAVON⚡️MARKS (@JavonTM1) June 27, 2024

According to some analysts, we’ve recently witnessed a significant technical development for XRP. The token has broken a year-long resistance trend on the logarithmic scale, indicating a potential major uptrend in the making. If this momentum continues, XRP could experience a staggering 243% surge against Bitcoin.

This prediction echoes a similar price rise XRP experienced in mid-2023. During that period, the token saw a remarkable 100% increase, while the XRP/BTC pair gained a respectable 63%. If Marks’ prediction holds true, the potential gains for XRP could significantly surpass those seen last year.

A New Dawn For XRP?

The analyst community is closely monitoring these developments with growing excitement. XRP’s potential to outperform Bitcoin is seen as a harbinger of a renewed bullish sentiment in the crypto market. With market dynamics shifting and investor confidence potentially returning, XRP could be poised to redefine its position within the cryptocurrency landscape.

Related Reading

Despite the inherent volatility of the crypto market, XRP’s recent resilience and potential for significant gains have captured the attention of investors. As the market navigates these uncertain times, XRP’s journey will be one to watch closely.

Featured image from Lockheed Martin, chart from TradingView

-

Hot Projects4 months ago

Hot Projects4 months agoBitcoin Blasts Past $70,000 to Register New All-Time High | MATIC News

-

Latest News4 months ago

Latest News4 months agoCourt upholds SEC’s unregistered securities claims against Gemini, Genesis’ Earn program | MATIC News

-

Latest News2 months ago

Latest News2 months agoSix Coinbase customers claim the exchange is violating securities laws in new lawsuit | MATIC News

-

Hot Projects2 months ago

Bitcoin Will Be Set For New ATHs If It Breaks This Resistance: Analyst | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoBitcoin ETF Inflows Could Eclipse $1 Trillion, Predicts Bitwise CIO | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoOndo Finance Joins BlackRock Tokenized Fund As Inflows Surpass $160M | MATIC News

-

Latest News4 months ago

Latest News4 months agoOver $1 billion wiped off HEX’s valuation following Richard Heart’s disparaging remarks | MATIC News

-

Latest News4 months ago

Latest News4 months agoCathie Wood sees Bitcoin at $1 million sooner than 2030 after record ETF performance | MATIC News