Hot Projects

MATIC Price Slumps 10% Amidst Market Downturn | MATIC News

MATIC, the native token of the Polygon network, has witnessed a significant decline in its value. It has fallen by more than 10% in the past week and 8% in less than 24 hours as the general cryptocurrency market continues to grapple with a cloud of negative sentiment.

Fortunately, the latest on-chain analysis has revealed the important levels that investors should look out for following the latest decline in the MATIC price.

Over 10,900 Addresses Bought 600 Million Polygon Tokens At This Price

According to a recent post on X by crypto pundit Ali Martinez, the price of MATIC has established a key support around its current price point. This evaluation is based on analytics firm IntoTheBlock’s on-chain data, which tracks the average acquisition price for any given wallet address.

The distribution of the Polygon token supply across various price ranges | Source: Ali_charts/X

Above is the chart highlighted by Martinez that shows the distribution of the Polygon token supply across various price ranges. The size of the dots in the chart represents the magnitude of coins purchased around the corresponding price range.

Most notably, over 10,900 wallet addresses bought a whopping 608 million MATIC around the $1.02 and $1.05 zone. According to the crypto analyst, this massive buying activity has supported the establishment of crucial support around this price region.

#Polygon has found crucial support between $1.02 and $1.05, supported by 10,900 addresses holding around 608 million #MATIC. Should this support falter, the next essential demand zone lies near $0.91, where 35,700 addresses collectively hold 394.6 million $MATIC. pic.twitter.com/rLn4ymcQf7

— Ali (@ali_charts) March 16, 2024

While the large size of the dot reflects the strength of this particular level, sustained bearish pressure could cause the price of MATIC to breach and fall beneath this support. In this case, investors could see the cryptocurrency drop to around $0.91.

This makes the $0.89 and $0.92 price range another level to watch, as it represents the next vital support area, where 35,680 wallet addresses purchased nearly 400 million Polygon tokens.

MATIC Price Overview

As of this writing, the price of MATIC stands at $1.04, reflecting an 8% decline in the past 24 hours. This price dip comes after the altcoin printed a multi-month high of $1.28 on Thursday, March 14.

According to data from CoinGecko, the Polygon coin has suffered a 9.7% price slump in the last seven days. From a broader perspective, though, the cryptocurrency has had a fairly positive performance in the past month.

With a market capitalization of more than $9.7 billion, the MATIC token ranks as the 18th-largest cryptocurrency in the sector.

MATIC price finds support around $1.04 on the daily timeframe | Source: MATICUSDT chart on TradingView

Featured image from Getty Images, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Hot Projects

These Are The Altcoins In Buy Zone, Analytics Firm Reveals | MATIC News

The on-chain analytics firm Santiment has revealed the altcoins that are currently in the historical buy zone according to a fair value model.

A Large Amount Of Altcoins Are Currently Near The Opportunity Zone

In a new post on X, Santiment talked about what the various assets in the cryptocurrency sector are looking like right now based on their Market Value to Realized Value (MVRV) ratios. The MVRV ratio is an indicator that keeps track of the profit/loss status of the addresses on any given network.

When the value of this indicator is greater than 1, it means the investors are carrying a net amount of profits right now. On the other hand, the metric under this threshold implies the dominance of losses in the market.

Naturally, the MVRV ratio being exactly equal to 1 suggests the unrealized loss on the network is exactly equal to the unrealized profit, so the average holder could be considered just breaking even.

Historically, corrections have become more probable when investor profits have ballooned up. Holders become more tempted to sell the larger their gains grow. Similarly, holders getting underwater has facilitated bottom formations, as sellers become exhausted during such conditions.

Based on these facts, Santiment has developed an Opportunity and Danger Zone Model that uses the MVRV ratio’s divergence on different timeframes to estimate better whether an asset is currently providing a buying or selling window.

Now, here is the chart shared by the analytics firm that shows where the different altcoins stand according to this model:

Note that in this model, the zero mark takes the role of the neutral 1 level from the MVRV ratio. Also, the polarity is flipped here, with values under zero implying profit dominance and those above signifying loss.

The graph shows that most of the altcoins are in the positive region right now, suggesting that their investors are underwater. Among these, Basic Attention Token (BAT), Chromia (CHR), and Highstreet (HIGH) particularly stand out as their MVRV divergence exceeds the 1 mark.

Under this model, the region above 1 is called the “Opportunity Zone,” as assets have historically offered the most profitable opportunities while inside it.

While most altcoins are at least slightly undervalued currently, a few, like Ethereum Name Service (ENS), MANTRA (OM), and Reserve Rights (RSR), are in or near the Danger Zone instead. The Danger Zone, which occurs under -1, is the counterpart to the Opportunity Zone, where coins become overvalued.

Ethereum Price

Ethereum, the largest among the altcoins, has faced a plunge of more than 4% in the last 24 hours, which has taken its price under the $3,300 level.

Hot Projects

Volume Up 90% — Good For ETH Price? | MATIC News

Ethereum (ETH) has become a beacon in the sea of blockchains, boasting a staggering 92% surge in dApp (decentralized application) volume over the past week. This news, however, comes with a layer of complexity, revealing a landscape of both opportunity and potential setbacks for the leading blockchain.

Related Reading

Cheap Gas Fuels The Fire

Analysts attribute the dApp volume explosion to the Dencun upgrade in March, which significantly reduced gas fees – the cost associated with processing transactions on the Ethereum network.

Lower fees have historically enticed users, and this recent development seems to be no different. The surge in activity suggests a revitalized Ethereum, potentially attracting new projects and fostering a more vibrant dApp ecosystem.

NFT Mania Drives The Numbers

While the overall dApp volume (see chart below) paints a rosy picture, a closer look reveals a more nuanced story. The surge appears to be driven primarily by a surge in NFT (Non-Fungible Token) trading and staking activity.

Applications like Blur and Uniswap’s NFT aggregator saw significant hikes, highlighting the booming NFT market on Ethereum. This trend indicates a thriving niche within the Ethereum dApp landscape, but raises questions about the platform’s diversification beyond NFTs.

A Look At User Engagement

A curious wrinkle emerges when examining user engagement metrics. Despite the impressive volume increase, the number of unique active wallets (UAW) on the Ethereum network has actually decreased.

This disconnect suggests that the current activity might be driven by a smaller, more active user base. While high volume is certainly a positive indicator, it’s crucial to see broader user participation to ensure the sustainability of the dApp ecosystem.

A Glimmer Of Hope?

One positive long-term indicator for Ethereum is the trend of decreasing exchange holdings, as reported by Glassnode. This suggests ETH holders are moving their assets off exchanges, potentially reducing sell pressure and contributing to price stability.

If this trend continues, ETH could potentially target reaching $4,000 this quarter or even surpass its all-time high. However, this price prediction remains speculative and depends on various market forces.

Ethereum At A Crossroads

Ethereum finds itself at a crossroads. The Dencun upgrade has demonstrably revitalized dApp activity, particularly in the NFT space. However, the uneven dApp performance and declining UAW raise concerns about the long-term viability of this growth. Network growth, measured by the number of new addresses joining the network, is also slowing down, according to Santiment, potentially hindering wider adoption.

Related Reading

The short-term price outlook for ETH remains uncertain. While the long-term indicators, like decreasing exchange holdings, suggest potential for price appreciation, the network’s growth slowdown might lead to a short-term price dip.

Looking Forward

The coming months will be crucial for Ethereum. The platform needs to capitalize on the renewed interest in dApps by attracting a broader user base and fostering a more diverse dApp ecosystem beyond NFTs. Addressing scalability issues and ensuring user-friendly interfaces will also be key to sustaining growth.

If Ethereum can navigate these challenges, it has the potential to solidify its position as the premier platform for decentralized applications. However, if it fails to adapt, other blockchains waiting in the wings might capitalize on its shortcomings.

Featured image from Pexels, chart from TradingView

Hot Projects

Analyst Says Bitcoin Is Hitting Range Bottom, “Right Before The Fireworks” | MATIC News

Crypto analyst Quinten François has provided an ultra-bullish narrative for the Bitcoin future trajectory. The analyst suggested that things are about to get interesting for the flagship crypto, predicting it could rise to as high as $4.5 million.

The “Fireworks” Are Just About To Begin For Bitcoin

While highlighting the significance of Bitcoin’s fourth halving, Quinten claimed that the “fireworks” were just about to begin for Bitcoin. The crypto analyst remarked that BTC was currently at the bottom of the range of a growth pattern, which it could enjoy if this fourth halving were to follow the same growth rate as the previous market cycles.

Related Reading

If that were to happen, Quinten claims that Bitcoin could be worth between $140,000 and $4.5 million going forward. He noted that this potential move for BTC is starting at the range bottom at $63,000, so he remarked that the fireworks are just about to start for the flagship crypto.

From the chart Quinten shared, Bitcoin’s impressive growth to $4.5 million isn’t expected to happen in this bull run. He predicts that Bitcoin could peak at around $1 million if it were to mirror Bitcoin’s trajectory after the first halving. Meanwhile, Bitcoin could eventually rise to $4.5 million in 2028 if it continues to mirror the price action following the first halving.

Additionally, BTC’S fourth halving mirroring the second or third halving will bring lower price moves for the flagship crypto. Quinten predicts that Bitcoin will rise to as high as $400,000 or $280,000 if it follows the second or third halving, respectively. Meanwhile, based on the second and third halving trajectory, Bitcoin could rise to as high as $1 million or $800,000 by 2028.

Time For BTC To Resume Its Upward Trend

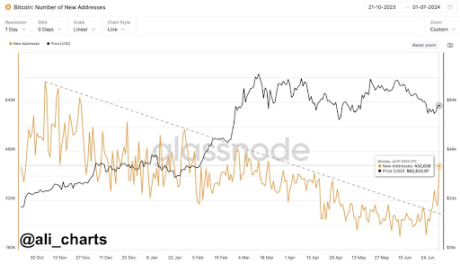

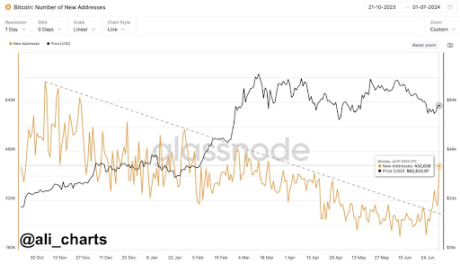

Based on recent analyses by different crypto analysts, Bitcoin could resume its upward trend soon enough. Crypto analyst Ali Martinez mentioned that retail investors are returning to the Bitcoin ecosystem, with new Bitcoin addresses hitting a four-month high of 432,026. This could put the flagship crypto in price discovery and lead to a rally as these investors accumulate Bitcoin.

Crypto analyst Mikybull Crypto also recently predicted that BTC is set to rise higher. He claimed that the flagship crypto had completed its inverse head-and-shoulder pattern on the daily and noted that Bitcoin’s Moving Average Convergence/Divergence (MACD) indicator suggests an imminent bullish cross, which indicates strength for the flagship crypto.

Related Reading

Meanwhile, Mikybull Crypto revealed that Bitcoin’s CME gap has been filled. This is significant as crypto expert Michael van de Poppe predicted that Bitcoin could witness a bounce from its current price levels once the CME gap has been closed.

At the time of writing, Bitcoin is trading at around $60,600, down over 3% in the last 24 hours according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

-

Hot Projects4 months ago

Hot Projects4 months agoBitcoin Blasts Past $70,000 to Register New All-Time High | MATIC News

-

Latest News4 months ago

Latest News4 months agoCourt upholds SEC’s unregistered securities claims against Gemini, Genesis’ Earn program | MATIC News

-

Hot Projects2 months ago

Bitcoin Will Be Set For New ATHs If It Breaks This Resistance: Analyst | MATIC News

-

Latest News2 months ago

Latest News2 months agoSix Coinbase customers claim the exchange is violating securities laws in new lawsuit | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoBitcoin ETF Inflows Could Eclipse $1 Trillion, Predicts Bitwise CIO | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoOndo Finance Joins BlackRock Tokenized Fund As Inflows Surpass $160M | MATIC News

-

Latest News4 months ago

Latest News4 months agoOver $1 billion wiped off HEX’s valuation following Richard Heart’s disparaging remarks | MATIC News

-

Hot Projects2 months ago

Hot Projects2 months agoPEPE Whales Go On Massive 720B Shopping Spree Amid Campaign For New ATHs, Is It Time To Get In? | MATIC News