Latest News

Perpetual futures trading volume surges as Bitcoin spot trading lags | MATIC News

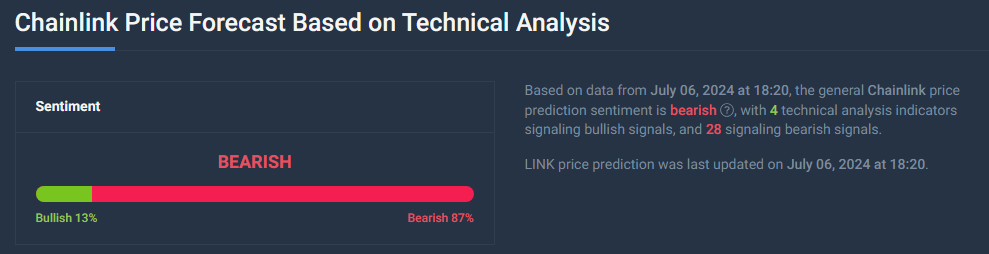

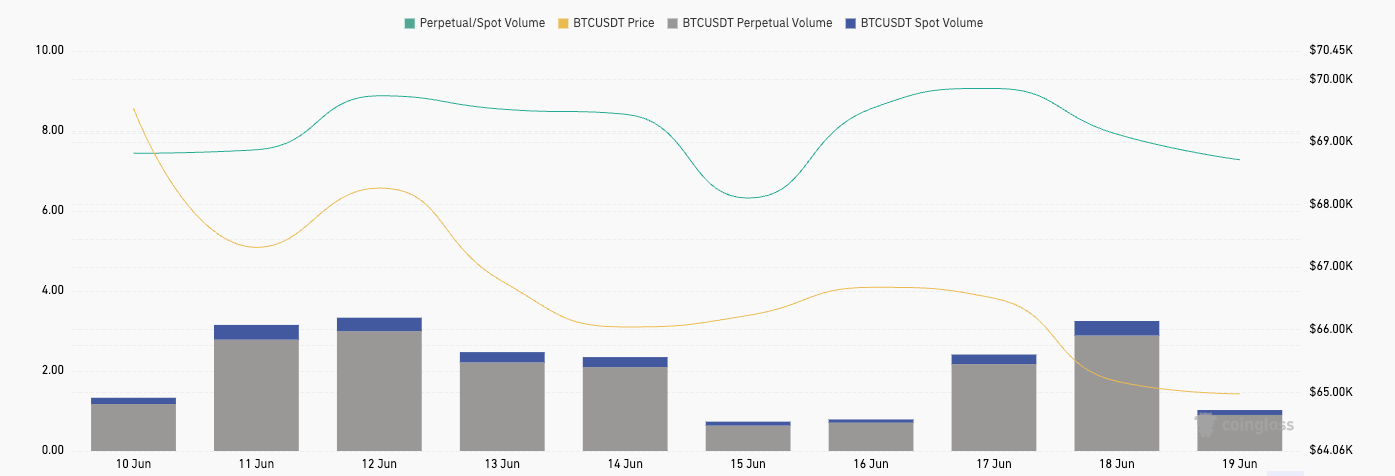

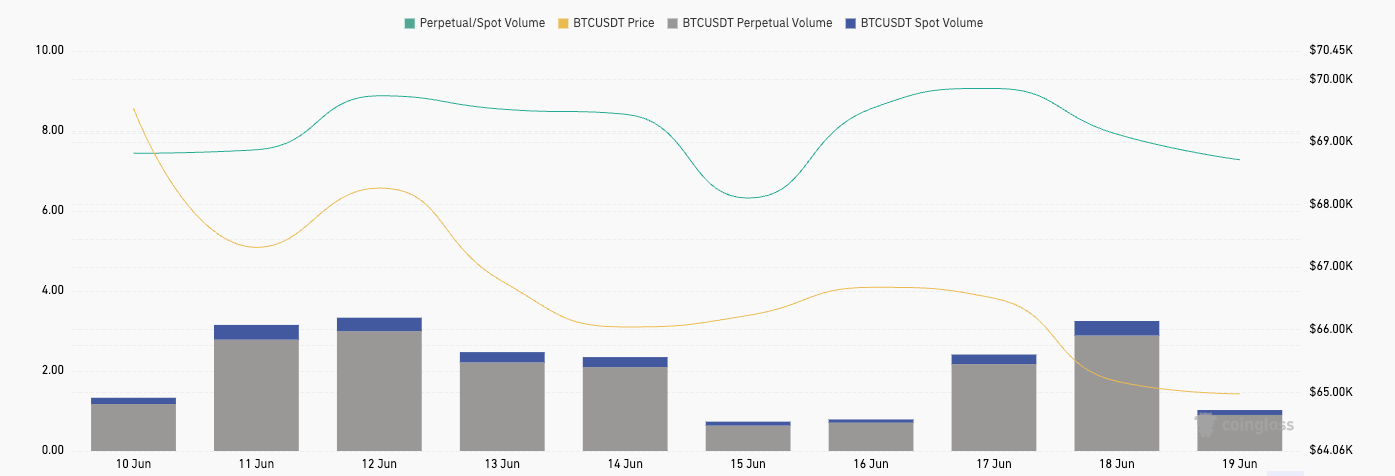

The Bitcoin derivatives market experienced significant volatility in the past week. In addition to fluctuations in open interest (OI), trading volume fluctuated significantly.

Data from Glassnode showed that the total 24-hour trading volume for perpetual futures across all exchanges dropped from $53.156 billion on June 12 to $10.910 billion on June 15. Trading volume rebounded to $51.239 billion by June 18.

When comparing these fluctuations with Bitcoin’s price during the same period, which dropped from $68,237 on June 12 to $65,160 on June 18, we notice that the trading volumes for perpetual futures do not move in strict correlation with price. For instance, the trading volume dropped significantly on June 15 and 16 while Bitcoin’s price remained relatively stable, indicating that trading volumes in perpetual futures are influenced by factors other than just price movements.

Looking at the trading volume for BTCUSDT perpetual futures on Binance, we observe a similar pattern of fluctuation, with a high of $22.65 billion on June 12, a low of $4.79 billion on June 15, and then a rise to $21.82 billion by June 18. This is more in line with the overall market trend, showing how significant Binance’s role is in the perpetual futures market.

Another discrepancy arises when comparing the perpetual futures trading volume on Binance with the spot trading volume for the BTCUSDT pair. The spot trading volumes are significantly lower, peaking at $2.75 billion on June 18 compared to the perpetual futures’ $21.82 billion on the same day. The perpetual-to-spot volume ratio, which varies from 6.32 on June 15 to 9.06 on June 17, shows a persistent preference for trading perpetual futures over spot trading on the exchange.

The difference between low spot volume and high perpetual futures volume can be indicative of the fact that new money is not entering the market at a significant rate. Spot trading, which involves the actual purchase and sale of Bitcoin, is generally associated with new market entrants looking to acquire the asset directly. A decline or stagnation in spot volume suggests that there may be fewer new investors buying Bitcoin, which could imply a lack of fresh capital flowing into the market.

On the other hand, perpetual futures are typically favored by more experienced and sophisticated investors looking to leverage their positions to maximize gains from price movements. Experienced traders might prefer perpetual futures due to their ability to hedge positions and the opportunity to amplify returns through leverage. Market makers and institutional players could also be responsible for the high volumes we’ve seen. They often use derivatives to manage risk and provide liquidity, significantly influencing the volume in perpetual futures markets.

Another important factor to consider is the acute state of the market. In a market characterized by uncertainty or a lack of clear direction, like we’ve seen in the past week, traders might prefer the liquidity and flexibility of derivatives. The ability to quickly enter and exit positions in the futures market allows traders to react to news and market changes more efficiently than they might in the spot market.

The post Perpetual futures trading volume surges as Bitcoin spot trading lags appeared first on CryptoSlate.

Latest News

Rethinking public blockchains to protect the fragile future of tokenization | MATIC News

Tokenization has taken center stage in Web3 over the past year, drawing immense investment and attention from BlackRock, JPMorgan, and other key players. Despite a ‘slow start’, analysts predict asset tokenization will reach a $2 trillion market size by 2030. Its momentum is evidenced by the surge in popularity of tokenized US treasuries during the recent bear market, with market capitalization soaring by 782% in 2023 alone, from $104 million to $917 million.

At the same time, the global blockchain gaming market is expected to reach $614.91 billion in 2030. The advantages are clear. Increased liquidity, enhanced transparency, heightened security, and seamless global access and ownership. Beyond finance and gaming, tokenization also holds the potential to revolutionize real estate, gaming, and supply chains; indicating a new era of accessibility and efficiency.

Public Blockchains and Their Limitations… The Big Problem

Despite these promising developments, the path to a fully tokenized world is fraught with challenges, particularly caused by public blockchains. Professor of Financial Regulation at American University, Hilary Allen, has previously warned of the “fragility” and inefficiency of public blockchains in the case of mass tokenization.

The issue? Scalability. Scalability issues plague popular public blockchains, hindering their ability to manage high transaction volumes. A Bitcoin transaction takes about an hour on average to be validated but this depends heavily on network congestion. Ethereum faces a similar scalability hurdle.

An uptick in transactions on the chain caused gas fees to skyrocket to record-breaking levels in the first quarter of 2024, slowing the network to a crawl and making it effectively unusable. Yes, gas fees have dropped since, but these issues remain a problem to be solved, and they extend beyond transactions into the minting and tokenization space.

The current infrastructure cannot support widespread mainstream tokenization adoption. Just like a crowded highway, most public blockchains like Ethereum that face these scalability issues can become overwhelmed by too much traffic, hindering their ability to house and scale tokenized assets efficiently and cost-effectively.

Security vulnerabilities further complicate things. The potential for hackers or nefarious groups to gain majority control of a blockchain’s consensus mechanism, often dubbed a ‘51% attack’, poses significant risks. Blockchain tech was specifically designed to prevent this from happening but, such an attack can lead to double-spending or transaction reversals, which for tokenized assets, could mean reversing ownership transfers that would cause chaos and a loss of confidence in the system.

However, obtaining a majority on either Bitcoin or Ethereum now would be cost-prohibitive: it would cost around $20 billion on Bitcoin. Bridges that connect different consensus systems and transfer value between them are also a chink in tokenization’s armor; unless these are extremely carefully constructed, they are at risk of hacks and exploitation.

Smart contracts are also vulnerable. If these are exploited, it can directly result in the loss of tokenized assets.

For tokenization to fulfill its transformative potential in areas like gaming and finance, it must be capable of scaling to tokenize a vast array of assets. The reality is that the current state of most public blockchains makes this infeasible.

Imagine if Minecraft was a blockchain-enabled game and every item a gamer crafted needed to be tokenized. Minecraft has over 166 million monthly active players. The sheer volume of in-game items that would need to be tokenized per day for each player would drastically impact blockchains like Ethereum, not to mention how the high levels of congestion would drive up gas fees.

Are There Robust Alternatives Beyond Public Blockchains?

‘Layer 2’ solutions that build on top of existing blockchains have often been touted as a fix for scalability and security issues facing tokenization at scale.

These solutions take much of the strain away from public blockchains, processing transactions off-chain or bundling transactions together before submitting them to a Layer 1, vastly reducing congestion and facilitating more efficient transactions at much lower costs.

However, these Layer 2 solutions are not without their limitations. They still depend on the underlying Layer 1 blockchain and there are often trade-offs between security, scalability, and decentralization with Layer 2 solutions. Most and perhaps all L2s are ‘blockchain-lite’; many L2s try to do the same as an L1 blockchain without the same security. To operate from the L1, they require transfer of currency (wrapped currency) which is very user-unfriendly and requires bridges.

Per L2Beat’s risk analysis, most Layer2’s come with risks. These include like the “the fact that “only a handful of whitelisted actors can submit”; “user withdrawals can be censored by the permissioned operators”; “there is no way to verify the system”; “Proof construction relies fully on data that is NOT published on chain”; and “Data depends on a Data Availability Committee with a threshold of 5/7”.

Bridgeless Minting

Alternative on-chain minting methods also promise avenues for improved scalability and efficiency. You may think this sounds like the job of a Layer 2, but solutions built on top of Layer 1s like Ethereum pay severe prices for security. Universal Layer 1s, unlike solo L1s like Avalanche, can exist untethered to a single network allowing for scalable interoperability between different ecosystems without bridges.

For example, Polkadot’s cross-chain protocol (XCMv3) allows blockchains to interact with each other seamlessly. L1s building with Polkadot can lean on an aspect of XCMv3 called ‘Universal Location’ which enables different consensus systems to refer to resources within each other.

Think of the way that the web uses URLs to refer to different websites and webpages: Universal Location does the same thing for blockchains, smart contracts, and tokens. This tech can be leveraged by L1s to develop bridgeless patterns by which every blockchain can offload part of their transactions.

Simple counting of on-chain transactions from the last 2 years shows that more than 20% of all transactions in Ethereum and Polygon can be offloaded right away. That’s not an insignificant amount.

Architecture such as these streamline token creation and management processes, drastically reducing the risk associated with cross-chain transactions and enhancing reliability overall. Imagine the ability to mint millions of assets on the blockchain of your choice, without paying native gas fees and remaining where the liquidity sits. That’s the power of bridgeless minting.

Unlocking Tokenization

The journey towards a fully tokenized world requires robust alternatives to public blockchains. Continued exploration and development of secure on-chain minting methods are crucial. By addressing the scalability and security challenges, we can unlock the full potential of tokenization, transforming industries such as gaming and finance and driving the next wave of digital innovation.

Mentioned in this article

Latest News

How institutional networks are preparin for Bitcoin integration | MATIC News

The following is a guest post from Shane Neagle, Editor In Chief from The Tokenist.

Half a year after Bitcoin ETFs launched, it is safe to say that they have been the most successful ETF launch in history, having generated a $309.53 billion volume. Just within the first day of trading, spot-traded Bitcoin ETFs pulled in $4 billion, crushing the previous record holder, Gold ETF (GLD), which took 3 days to top $1 billion in inflows.

This is all the more impressive as Bitcoin is a novel asset compared to ancient gold. The trend clearly points to Bitcoin being more fit for purpose in the digital age. But what is that purpose?

BlackRock’s Head of Thematic & Active ETFs, Jay Jacobs, recently noted that Bitcoin is a “potential hedge against geopolitical and monetary risks”. By now, most people are aware that central banks’ ability to tamper with the money supply brings many moral hazards, from record-breaking budgetary deficits to inflation as an extra layer of taxation to cover those wild spending sprees.

Gold is less suited to counter that ability because it is physical, confiscatable, and not truly limited. Because Bitcoin is one-tenth the size of the gold market, its price is more volatile, but it is also a more attractive gains machine.

Now that Bitcoin ETFs have simplified and institutionalized access to more exciting digital gold, which steps are needed to ensure that trend continues?

Ensuring Network Reliability

Owing to its proof-of-work (PoW) consensus mechanism, Bitcoin is dual-natured. It is a digital asset anchored into the physical reality of energy and hardware. This underlying foundation gives Bitcoin its value as a decentralized counter to central banking.

In turn, the components of that foundation, the Bitcoin network, have to scale up to continue the institutional intake. Presently, the Bitcoin network handles around 412k transactions per day, nearly double from two years ago. Although the median transaction fee oscillates depending on network load, it rarely exceeds $5 per transaction.

In parallel, their networks have to scale to ensure the Bitcoin network handles orders of magnitude greater load coming from institutions. To increase their stability and robustness, they have to tackle multiple network components, from software and servers to hardware and internet connection.

Scalable Blockchain Solutions

Just as IBM made significant contributions to developing current large language models (LLM), the legacy computer company also made a strong case for blockchain scaling with IBM Blockchain. This immutable ledger is based on an open-source Hyperledger Fabric framework with a complete set of tools for building blockchain platforms.

Such a framework could interface with the Bitcoin ecosystem via atomic swaps, such as virtual vaults with timed smart contracts. Similarly, Visa proposed an experimental Universal Payment Channel (UPC) framework as a hub for blockchain network interoperability. International banking network SWIFT had already completed the second test phase for atomic settlement capability.

Zooming out, a picture emerges of enterprise-grade blockchain solutions for institutions, interlinking with international hubs and intermediating with institutions that handle exposure to Bitcoin, such as Coinbase.

Dependable Servers

Powering scalable blockchain solutions comes in the form of hardware. These can either be internal servers, via customized solutions offered by Broadcom, or offloaded to external options like the Canton Network.

As a decentralized infrastructure, the Canton Network is a network of networks, building on Daml smart contract language and micro-services architecture. The latter allows for each service plugged in to to have its own server, expandable with more CPUs and storage.

Using atomic settlements, the Canton Network makes real-time settlement possible across different blockchain apps. By outsourcing services to such networks, businesses and institutions can focus on core features rather than IT infrastructure management, including the maintenance of CPUs, dedicated GPU hosting to diversify into AI support, and other essential hardware.

Internet Connectivity

Nodes in any blockchain network have to communicate continuously to validate transactions and execute settlements by adding them as the next block on the blockchain ledger. In other words, internet connectivity necessarily involves redundancy and failover strategies.

For example, when Solana experienced network downtime problems, co-founder Anatoly Yakovenko hired Jump Crypto to develop Firedancer as a secondary network validator client to fortify network throughput and stability.

With broader solutions like the Canton Network, enjoying support from the Big Tech and Big Bank, redundancies, multi-channels, backup systems, and load balancing are already baked into the DLT cake.

Enhancing Network Performance

It is inherent in all types of computer networks to suffer from some level of packet loss and jitter. Packet losses can happen due to overwhelming demand, causing congestion, network interference, faulty software or hardware, and data corruption on hard drives.

Transmission Control Protocols (TCP) deal with packet losses by retransmitting data, which causes delays, or by Forward Error Correction (FEC), which adds redundant data to packets, removing the need for retransmission. The Bitcoin Relay Network uses FEC to this effect, as does the Blockstream Satellite network, as an alternative avenue to receive Bitcoin blockchain data.

As for jitter, certain data packets can arrive at different intervals. When this jitter happens, packets land in different orders, disrupting data stream. The jitter problem is typically handled with buffers that temporarily store streamed packets to ensure their correct order arrival.

Another way to handle jitter is to introduce quality of service (QoS) network configurations that prioritize critical traffic. This can also be applied to reduce packet loss. Network design itself is a big factor in reducing jitter by making sure the network has as few hops as possible.

The Bitcoin network benefits from its decentralized design because each transaction requires multiple confirmations. If jitter occurs, later confirmations offset the delays. Most importantly, the Bitcoin mainnet has an auto-adjusting difficulty mechanism that maintains the average block time at 10 minutes.

In practice, the management of the network’s data packet loss and jitter lands on on-site vs. ISP solutions.

On-site vs. ISP Solutions

On-site solutions require organizations to handle their IT infrastructure. While this gives institutions total control, including regulatory data compliance and faster personnel response, the upfront costs for hardware and storage are significantly higher.

On the other hand, ISP-hosted solutions are easier to scale as specialized companies are likely to be well-oiled machines, handling both maintenance and network uptime. On the clients’ end, this requires a reliable internet connection and the selection of the best packet loss and jitter metrics.

Case in point, Amazon Web Services (AWS) gives clients a Global Accelerator tool to enhance and balance network performance. Alongside Amazon Managed Blockchain and Quantum Ledger Database (QLDB), such services propelled AWS to become one of the infrastructure pillars of the blockchain space.

As for ISPs themselves, they are typically less forthcoming on their jitter/packet loss metrics, as they rely on several factors. To that end, there are many tools to track network latency, packet loss and jitter, such as PingPlotter.

Jack Dorsey’s Block (former Square) opted to build its own Bitcoin mining network, utilizing its 3 nm chip design, likely built by TSMC foundries. With an in-house, open-source mining hashboard, which is compatible with Raspberry Pi controllers, Block is heading to set up new standards for the Bitcoin ecosystem.

The other piece of the Bitcoin scalability puzzle revolves around energy.

Sustainable Energy Solutions

It is often said that Bitcoin is digital energy, or better yet, tokenized energy. Ultimately, Bitcoin’s proof-of-work sets it apart from thousands of copypasta cryptocurrencies, making it virtually unassailable from a network security standpoint. And that consensus algorithm exerts energy, as expected from any work.

But how much and what kind of energy? Bitcoin’s energy expenditure is often compared to a nation’s footprint, such as the Netherlands or Argentina. It is sufficiently high for Greenpeace to call for a campaign to change Bitcoin from proof-of-work to proof-of-stake.

BRÆKING: @greenpeaceusa continues its SEXIST anti-#Bitcoin campaign, releasing new video about “Bitcoin BROS.”

NEWSFLASH to Greenpeace misogynists: there are WOMEN in Bitcoin, & Bitcoiners will not stand by while you ERASE them.

Please retweet if you think Greenpeace is sexist. pic.twitter.com/qX3emR8TaL

— Walker⚡️ (@WalkerAmerica) June 22, 2024

Yet Greenpeace itself could launch such a shift, given that Bitcoin’s open-source code is available to all. The problem is that without a network and market interest, such a tweak would be meaningless.

In the meantime, over 50% of the Bitcoin network draws power from renewable sources. According to Daniel Batten’s research via Batcoinz, most of it comes from hydro, wind, solar, and nuclear.

Not only did Bitcoin step onto the majority-green territory, but it has been acknowledged as a key ingredient in balancing power networks. Namely, the Electric Reliability Council of Texas (ERCOT) pays large Bitcoin mining companies, such as Bitdeer and Riot Platforms, to stabilize the grid during anomalous conditions such as heat waves.

As recently as June 13th, ERCOT recommended that Bitcoin mining be directly integrated as a Controllable Load Resource (CLR) to boost power grid balancing. Additionally, there is an increasing trend for Bitcoin miners to use flared gas from oil drilling operations. Otherwise wasted and burned off, this byproduct can be captured to power Bitcoin mining rigs.

Now that BlackRock, the main driver of the ESG framework, is pushing Bitcoin, this is a clear signal to institutional investors that the “dirty Bitcoin” narrative is a bygone concern.

Block has yet to reveal its 100% solar-powered mining facility in West Texas. However, multiple Bitcoin mining companies, such as Bitfarms, Iris Energy, TeraWulf, and CleanSpark, have already transitioned to near-zero carbon footprints.

With nuclear power on the horizon due to AI data center demands, investors should expect even greater greening of Bitcoin operations. And in the likelihood of Donald Trump’s victory in the next presidential elections, Bitcoin sustainability concerns will further fade away.

Conclusion

In 2022, Messari noted that gold mining produces three times as many carbon emissions as Bitcoin. Since then, Bitcoin has outperformed gold ETF capital inflows by an even greater magnitude.

It turns out that there is great value to be found in an asset that cannot be tampered with on a practical level and is not controlled by anyone. Rather, Bitcoin is enforced by ingenious cryptography, tethering code to hardware assets and energy.

With capital damn broken, and access to Bitcoin exposure put on the same level as any other stock, it is a race to new highs and new lows to buy the dip. Building from the experience of other blockchain networks and mining companies, the tech is readily available to tap into this growing ecosystem.

Latest News

Ex-Obama Solicitor General accuses regulators of intentionally debanking crypto firms | MATIC News

Former Solicitor General Donald B. Verrilli, who served during the Obama administration, has accused US regulators of intentionally stifling the crypto industry through debanking practices.

Verrilli, who now serves as Grayscale Investments’ senior legal strategist, made the remarks in a joint amicus brief filed on July 3 with Paul Clement, the former Solicitor General under President George W. Bush.

The statement highlighted growing bipartisan concerns about the regulatory environment for digital assets and

Debanking claims

The amicus brief was filed on behalf of Custodia Bank, which is appealing a Wyoming district court’s decision to grant the Federal Reserve discretion to deny it a Master Account.

In a joint statement with Clement, Verrilli suggested that the Office of the Comptroller of the Currency (OCC) has issued informal guidance that effectively limits banks’ ability to engage with crypto firms.

He argued that these guidelines, though not official, set stringent requirements that are difficult for banks to meet, impacting their ability to support the growing crypto industry. Additionally, the brief argues that such practices amount to a deliberate effort to debank the crypto industry, stifling competition and innovation.

Verrilli was particularly critical of the court’s decision in favor of the Fed, describing it as a significant obstacle for the crypto sector. His comments, supported by Clement, reflect a broader bipartisan concern about the current regulatory approach toward the crypto industry.

Fox Business journalist Eleanor Terrett recently reported on Verrilli’s perspective, noting the potential consequences of the Fed’s decision. Some market analysts warn that without more adaptive regulations, the United States could lose its competitive edge in the global crypto market.

Terret added that Verrilli and Clement’s joint support for Custodia Bank signals a shifting political landscape around crypto, with bipartisan backing growing as the November election approaches.

Growing influence

Digital assets are becoming a significant issue in the upcoming 2024 US elections, influencing both political discourse and voter behavior. The crypto industry has gained substantial traction, with its advocates pushing for more favorable regulations and greater acceptance among lawmakers.

This has led to increased political engagement from both industry stakeholders and voters interested in digital assets, with key political figures and presidential candidates increasingly aligning themselves with the crypto sector.

Former President Donald Trump recently pledged to support the interests of digital asset traders and has started accepting campaign contributions in cryptocurrencies. On the Democratic side, Robert F. Kennedy Jr. has also embraced cryptocurrencies, with his campaign accepting crypto donations and advocating for the protection of Americans’ rights to use and hold digital assets.

This growing political alignment is seen as crucial for mobilizing younger voters, who are typically more inclined to invest in cryptocurrencies. According to recent data, Millennials and Generation Z make up a significant portion of the crypto user base, and their support could be pivotal in close elections.

A poll by the Crypto Council for Innovation (CCI) found that a candidate’s stance on digital assets is important to many voters, with 83% of those surveyed preferring candidates who advocate for clear crypto regulations.

Meanwhile, Crypto entities are preparing to spend over $80 million on the elections, aiming to boost allies and promote legislation favorable to the industry. This has resulted in surprising bipartisan support for crypto-friendly legislation, with notable figures like Senate Majority Leader Chuck Schumer and former House Speaker Nancy Pelosi emerging as unexpected allies

Mentioned in this article

-

Hot Projects4 months ago

Hot Projects4 months agoBitcoin Blasts Past $70,000 to Register New All-Time High | MATIC News

-

Latest News4 months ago

Latest News4 months agoCourt upholds SEC’s unregistered securities claims against Gemini, Genesis’ Earn program | MATIC News

-

Hot Projects2 months ago

Bitcoin Will Be Set For New ATHs If It Breaks This Resistance: Analyst | MATIC News

-

Latest News2 months ago

Latest News2 months agoSix Coinbase customers claim the exchange is violating securities laws in new lawsuit | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoBitcoin ETF Inflows Could Eclipse $1 Trillion, Predicts Bitwise CIO | MATIC News

-

Hot Projects3 months ago

Hot Projects3 months agoOndo Finance Joins BlackRock Tokenized Fund As Inflows Surpass $160M | MATIC News

-

Latest News4 months ago

Latest News4 months agoOver $1 billion wiped off HEX’s valuation following Richard Heart’s disparaging remarks | MATIC News

-

Latest News2 months ago

Latest News2 months agoNew Hampshire representative proposes Bitcoin ETF investment to address state financial liabilities | MATIC News